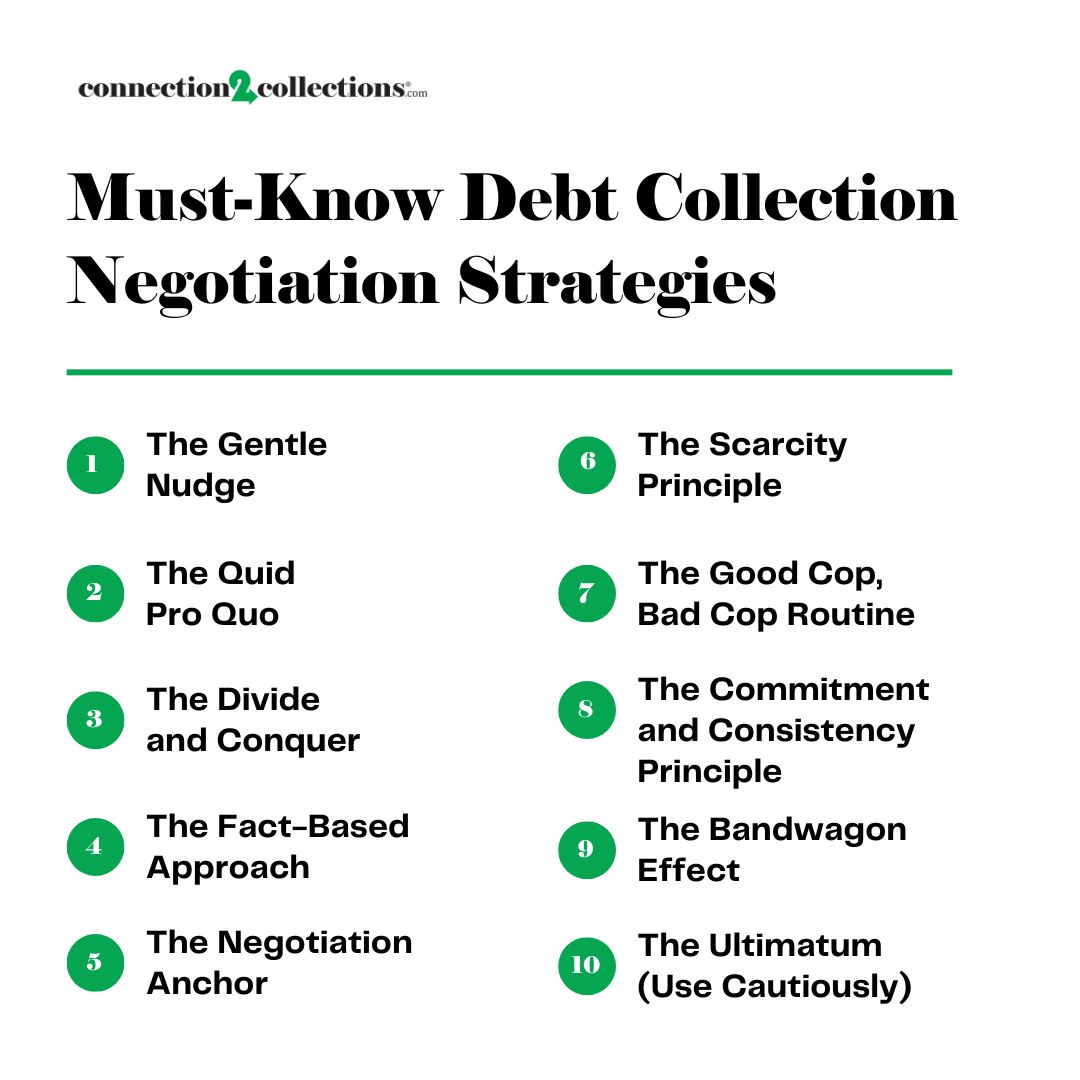

10 Must-Know Debt Collection Negotiation Strategies

Debt collection is similar to tug of war. Here you are at one end, straining your every fiber to pull those dollars closer to you. Meanwhile, the debtor is at the other end, striving to ensure the money doesn’t end up in your hands. It’s a task that’s full of challenges, frustration, and at times, looks like it’s a waste of time. But do not fret, because there are strategies that can be used to even the odds and even swing the balance back in your favor!

As you know, debt collection agencies are not only about balancing the books; they pioneer the fascinating attempt of solving the puzzle of human nature. Negotiation is more than an art; it is a true science. It requires one to negotiate in the appropriate manner, with the right blend of assertiveness and diplomacy. Any bargaining tactics or strategies that you may have up your sleeve are a force to reckon with when it comes to recovering debts!

So today, we’ll discuss some of the top, must-know business negotiation strategies that will have you collecting debts like a boss!

10 Must-Know Debt Collection Negotiation Strategies

There are usually some tough moments when trying to recover debts. Therefore, it’s important to have appropriate negotiation strategies in hand. It’s even more critical to know how to negotiate with a debtor who isn’t willing to pay his or her debts. As well as to handle complicated cases. Below are some tried-and-true strategies that will come in handy at the negotiation table:

The Gentle Nudge

The Gentle Nudge strategy involves politely informing the debtor of the debt and expressing a desire to reach a mutual agreement on repayment.

This could involve suggesting repayment plans tailored to their current economic situation and considering any pressing issues they face, possibly offering an extended grace period. Avoid aggressive tactics; instead, focus on understanding and building a healthy relationship with the debtor.

The Quid Pro Quo

The Quid Pro Quo strategy leverages the idea that people are motivated by receiving something in return. Offering cash can be particularly enticing. By providing something valuable in exchange for cooperation, you increase the likelihood of reaching a favorable conclusion.

This strategy could involve letting the client pay a percentage of the balance, removing higher interest rates, or offering a rebate for early payment. For example, offer a 10% discount if the debtor pays in full within 30 days.

The Divide and Conquer

Many debtors find the very concept of following a lump-sum payment plan to be inconceivable. That is where the Divide and Conquer strategy applies. By dividing the debt into portions, settling debt becomes much less frightening.

Offering the owed figure as one giant sum might be counterproductive, as the debtor would feel the pressure of having to pay off in full. Instead, you can work out a plan that will help the debtor to pay you in installments. This could include suggesting the use of a timetable that would entrench realistic monthly reimbursement proposals.

Not only does this approach make the debt feel more psychologically digestible but it also makes it feel like they’re actually getting something done as each checkpoint is hit. Such achievements can help keep their spirit high and keep them on track till the issue is resolved.

The Fact-Based Approach

In most civil action suits, especially those involving debts, emotions usually come into play whereby debtors may deny or play down the amount of the debt. This is where the Fact-Based Approach can come in handy. It fully discards any possible vagueness and brings all the evidence to the table. Thus, you can make your claim with as much authority as can be reasonably expected.

This method requires systematically collecting and producing proof of all transactions, preventing debtors from denying or deflecting claims against them.

The Negotiation Anchor

This strategy creates an initial reference point for negotiations based on the psychological concept of anchoring. It starts by presenting a slightly higher (but realistic) figure or demand as your opening offer during negotiations. This would create an ‘anchor’ on which further negotiations can center around. It will also influence the debtor’s perception of what constitutes a fair and acceptable resolution.

For example, if the debt is $10,000, you might start by offering $12,000 in full settlement or monthly installments. This higher initial offer sets a tone that makes the debtor more likely to negotiate down to the actual $10,000, ensuring collectors are paid in full.

The Scarcity Principle

Perhaps the most impactful element of marketing is the principle of scarcity. This is a psychological theory of marketing that states that the more scarce an object is, the more valuable it becomes. This principle can be used in debt collection negotiations to put pressure or even provide incentives to act within a given timeframe.

This strategy requires telling the other party that the proposed terms or concessions are only available for a limited time; a time-bound offer. For example, you may choose to provide a discount or waiver for a short period, say within the next one month. You may also decide that no late-fee charges will be applicable if the amount is paid within this period.

When you paint a picture that the concessions you are willing to offer your debtor are rather scarce, you appeal to the debtor’s basic instincts and their desire not to miss a great deal. This psychological trigger can help them act at a faster pace and make conscious efforts to offset their debts.

The Good-Cop Bad-Cop Routine

This negotiation tactic involves two parties playing contrasting roles: one adopts a rigid, strict demeanor while the other is flexible and approachable. By alternating between these approaches, they create a conflict situation that pressures the debtor to accommodate the rational party.

The ‘bad cop’ should be more aggressive and less considerate. He should emphasize on the validity of debt and hammer on the unavoidable, hefty repercussions awaiting defaulters. This persona should convey the message that the firm will not accept any delay or soft tactics to reclaim the dues owed to it.

The “good cop” approach involves being understanding, listening to the debtor’s problems, and showing sympathy. This persona should present themselves as empathetic. And willing to compromise, offering a reasonable solution that the debtor is likely to accept.

The Commitment and Consistency Principle

This approach leverages self-perception theory, which suggests people prefer to remain consistent with their past statements and commitments. By subtly reminding the debtor of their previous acknowledgments of the debt’s validity, you can apply psychological pressure for them to honor their prior admissions.

The Bandwagon Effect

The Bandwagon Effect strategy relies on the strength of social proof and human’s innate tendency to follow the crowd or other people’s footsteps. Here, it’s recommended you convince the debtor that other debtors have cooperated with your terms. And now, their debts have been cleared through your ‘debt-alleviation’ program or process.

The Ultimatum (Use Cautiously)

Although an overly assertive approach is actually undesirable when negotiating a settlement, there are occasions when it is helpful to present an ultimatum. However, this is a weapon that should be used sparingly.

This strategy involves making clear to the client the undesirable consequences they stand to face if they continue not to pay. This may include legal actions, asset seizure, or even negative credit reporting. But at the same time, present a logical way forward.

This approach balances assertiveness and empathy, conveying the seriousness of the issue without being confrontational. You need to deliver the message clearly while maintaining a respectful and understanding tone.

Each strategy has its own role to play during the debt collection depending on the circumstances of the case.

The key to dealing with debt collection is the ability to be somewhat merciful and at the same time take a firm stand with debtors. One must never try to threaten or act too aggressively with a debtor. Because it’s against the debt collection practices act. See, that kind of aggressive, hostile behavior only creates more hostility and closes doors on people.

That said, let me invite you to check out Connections2Collections. This is a platform that every individual or debt-settlement company can’t afford to be without. Aside from sharing great knowledge and ideas through our posts, we also support an active community dedicated to upscaling.

With Internet access and a few minutes of your time, you can create your own jobseeker or employer account and start exploring our job listings. You’ll also enjoy other benefits like the opportunity to make contacts with other professionals or veteran credit counselors, provide and receive useful recommendations. And to receive assistance concerning career advancement. Finally, you can find mentors for yourself, get up-to-date job offers, and stay updated in this constantly developing field. See you there!