Legal Collections vs. Non-Legal Collections

We’ve all been there. The unsavory feeling when we’re owed some money but the debtor is not very keen to do what’s necessary. It’s annoying, it’s tiring, and it can drain multiple wallets. Unpaid debts are somewhat like those small pebbles in your shoe; they may be small, but they sure can cause a whole lot of trouble!

Therefore, what do you do when friendly nudges and professional emails have proven to be a waste of time? Well, that’s where debt collection law firms step in to collect the debt on your behalf. For companies, these unpaid invoices can be the thin line between business expansion and stagnation. For the involved individuals, these debts may be the difference between a restful night’s sleep or the tossing and turning kind.

However, attempting to recover different types of debts may not always go as desired. There’s no magic wand to wave that’ll make the money suddenly appear in your account. Nevertheless, there are certain legal and non-legal strategies collection attorneys can employ in times like this.

That’s why I’m dedicating this post to breaking down the differences between legal and non-legal collections.

Legal Collections vs Non-Legal Collections

It goes without saying that debt collection is not the most enjoyable or easy task in the world. It can be complicated, tedious, and even, at times, very puzzling. But, do not fret. Soon, I’ll provide you with simple and actionable steps on legal and non-legal processes of debt collections for your day-to-day practice.

Why is this so important? Well, choosing the right course of action is the key to getting your money back or kissing it goodbye. Aside from helping creditors recover amounts owed, some collection companies also act as debt buyers. Here, they approach creditors such as credit card companies, water firms, and banks, look at the outstanding debts, then try to buy the debts from the borrowers.

Is Debt Collection Legal?

Yes, debt collection is legal. But it’s a job that must be done according to certain guidelines.

Think of debt collection like driving a car. Sure, you can drive, but there are rules of the road you need to follow. If you decide to run a red light or to speed excessively, you’ll find yourself in deep trouble. Debt collection companies mostly operate in similar fashion.

There are a series of laws and regulations that exist for obvious reasons. These laws serve as guides to ensure proper conduct by collectors, debtors, and even the original creditors. They shield the consumer from being exploited while at the same time allowing the collector a rightful means of recovering the dues.

However, debt collection laws are not all about restraints. It also provides collectors with legal frameworks for acceptable conduct, proper communication, documentation, and dispute resolution.

What Are the Laws for Debt Collectors?

Although there are so many laws, we’re going to concentrate on the biggest of them all, the Fair Debt Collection Practices Act (FDCPA).

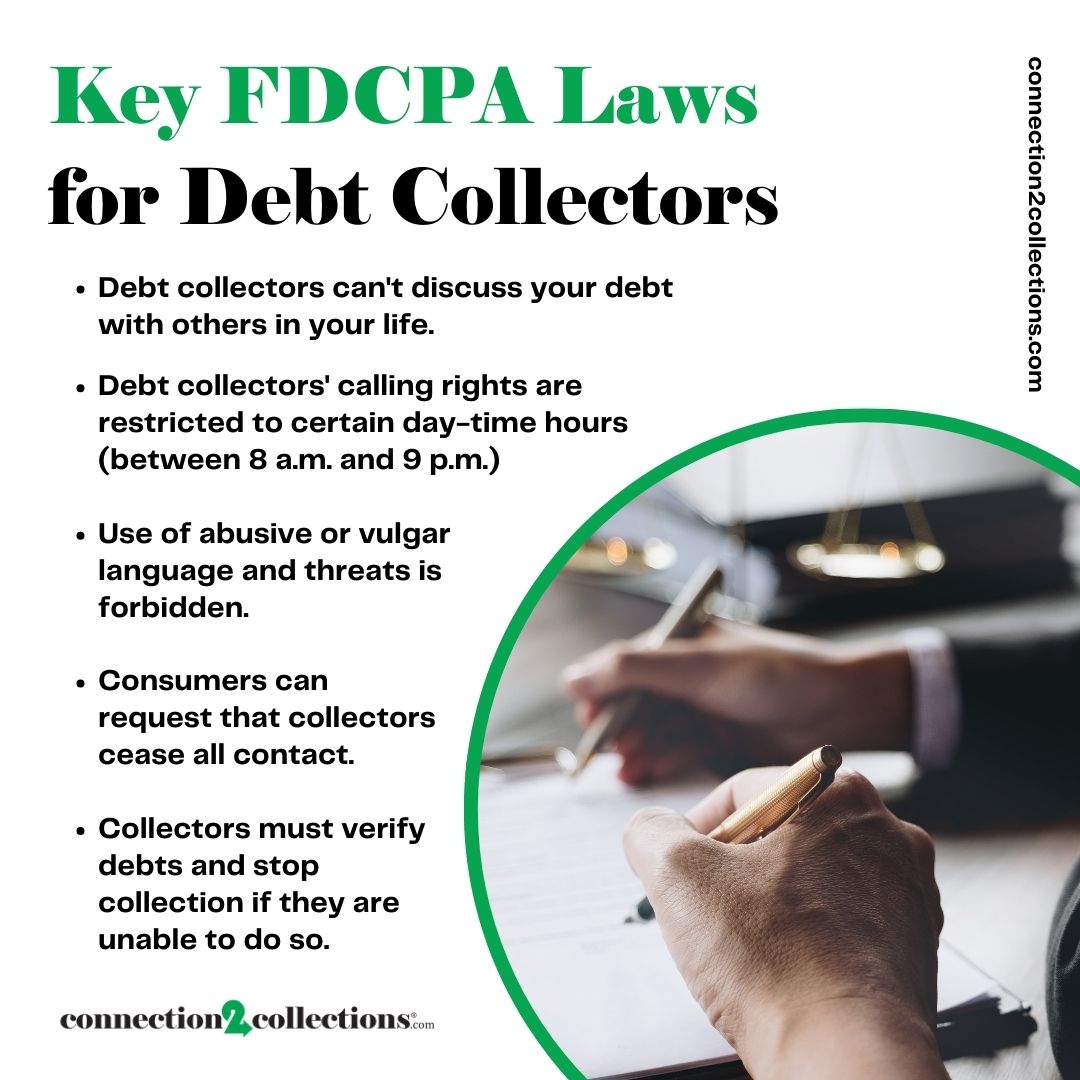

Here are some of the FDCPA laws every collector should know like the back of their hand:

- Debt collectors can’t discuss your debt with others in your life.

- Debt collectors’ calling rights are restricted to certain day-time hours (between 8 a.m. and 9 p.m.)

- Use of abusive or vulgar language and threats is forbidden.

- Consumers can request that collectors cease all contact.

- Collectors must verify debts and stop collection if they are unable to do so.

What are Legal Collections?

Put simply, legal collection is the process of going through the court to force debtors to pay off their debts. It’s like calling on the referee when the other team does not want to abide by the game’s regulations. You’re simply saying, “Okay, if you are not going to pay voluntarily, we’ll let a judge decide.”

Legal collections are protected by law. This implies that should you choose this path; the legal system will back you to the fullest. This can be via wage garnishment, property seizure, or bank account freeze all of these are possible when the court steps in.

Of course, legal collections aren’t always the answer. They can be quite time-consuming and slightly expensive, especially if you’re not conversant with them. Plus, if your debtor is what we in the business call “judgment-proof” (broke), even a court order might not get you your money back. However, legal collections may be very effective against those stubborn personalities who have the capacity to pay but just won’t budge.

What are Non-Legal Collections?

First things first: let’s clear something up right off the bat. Non-legal collections are not some shady, back-alley activities that will put you in soup. Rather, it refers to certain approaches to debt collection that do not include legal action. It’s diplomacy before filing a lawsuit and declaring war.

However, while there is nothing illegal about non-legal collections, there are certain activities in this domain that are unlawful.

So, what’s off-limits? Well, you can’t.

- Harass or threaten the debtor.

- Use deceptive tactics to collect the debt.

- Call the debtor at unreasonable hours.

- Talk about their debt with unauthorized third parties.

Non-legal collection procedures aren’t about strong-arming anyone. On the contrary, they are about starting conversations, finding common ground, and working towards mutually beneficial solutions.

Examples of Non-Legal Collections

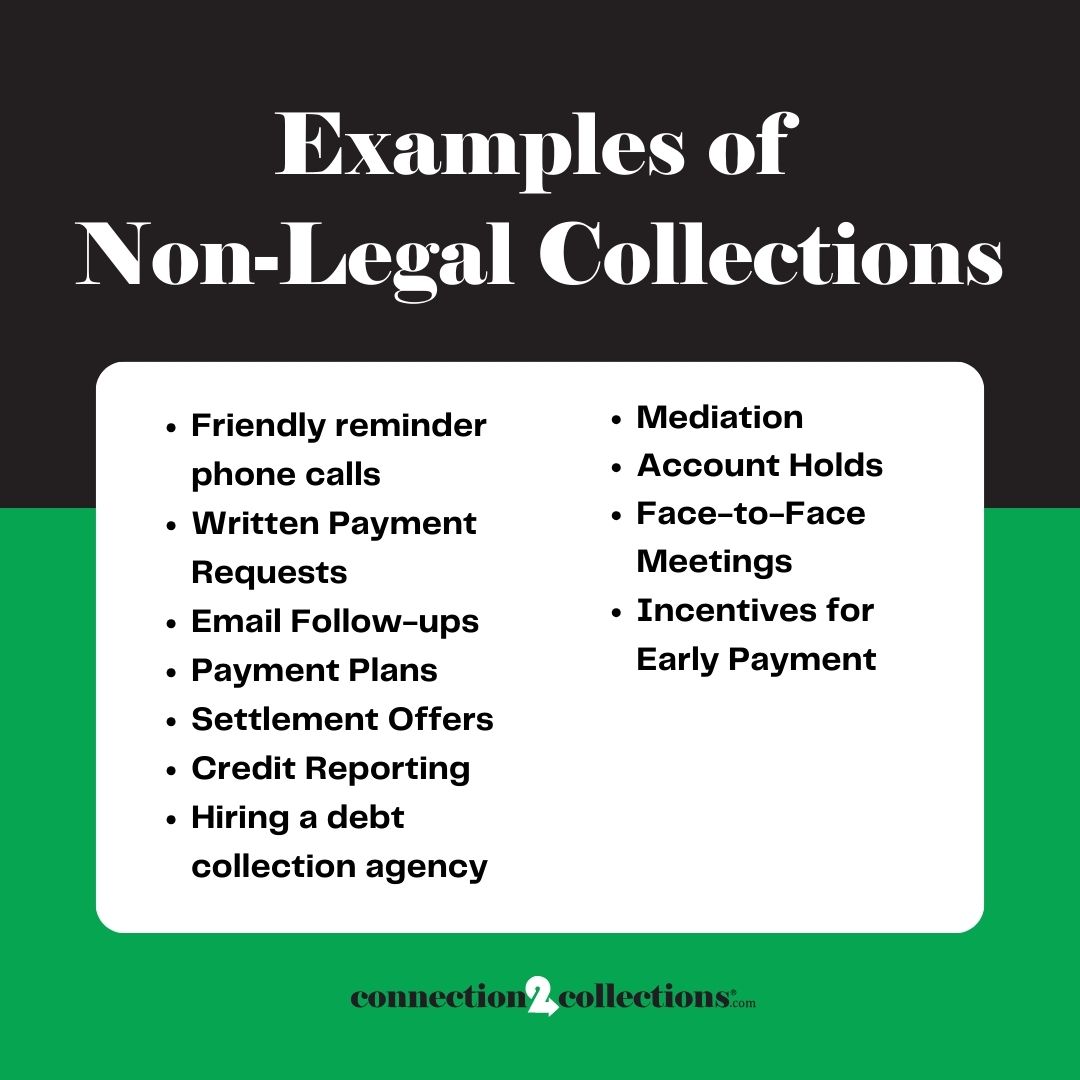

Here’s a rundown of some common non-legal collection tactics:

- Friendly reminder phone calls

- Written Payment Requests

- Email Follow-ups

- Payment Plans

- Settlement Offers

- Credit Reporting

- Hiring a debt collection agency

- Mediation

- Account Holds

- Face-to-Face Meetings

- Incentives for Early Payment

Debt recovery is about finding the right balance between assertiveness and empathy, between using the law and preserving relationships.

By now, you should be in a much better position to deal with different types of debt situations. However, learning doesn’t end. You can further equip yourself with more knowledge on legal and other non-legal ways of collecting debts by attending debt collection conferences.

But you shouldn’t stop here? If you’re looking to truly excel in the debt collection industry, it’s time to take the next step. That’s where Connections2Collections comes in. This isn’t just another job board; it’s a community of debt collection professionals eager to help you climb that career ladder. So, whether you’re looking for that perfect job or looking to hire top talent, Connections2Collections is here to help.

So why wait? Join the Connections2Collections family today. It’s quick, it’s easy, and it could be the boost your career needs at the moment. Who knows? Your next big opportunity or your next star employee could be just a profile away!