How to Check Collections Debt: Essential Steps Before Making Any Payments

Running a business is no joke–there’s always something demanding your attention. You have employees to manage, customers to keep happy, and lots more. With so many pressing matters to attend to each day, dealing with financial cleanup probably ranks last on your to-do list. Meanwhile, those unopened envelopes, those “we’ve been trying to reach you” emails, have a way of multiplying while you’re preoccupied elsewhere.

But here’s the thing: ignoring those collection notices is like ignoring the check engine light on your car. Sure, you can turn up the radio and pretend everything’s fine, but sooner or later, it’ll catch up with you. And when it does, you may end up being stranded on a highway. The financial equivalent of this isn’t any less palatable!

But there’s good news–getting a handle on your collection debt doesn’t necessarily have to become a burden. In fact, it’s like cleaning out your garage. The hardest part is deciding to start. But once you’re done, you’ll wonder why you didn’t do it sooner. That’s why today I’ll be sharing a guide on how you can check collections debt and get it sorted in no time!

A Guide on How to Check Collections Debt

Finding out that your debts in collections can be overwhelming, but take a deep breath you’re about to take control of the situation. Below are the steps to tackle any collection debt:

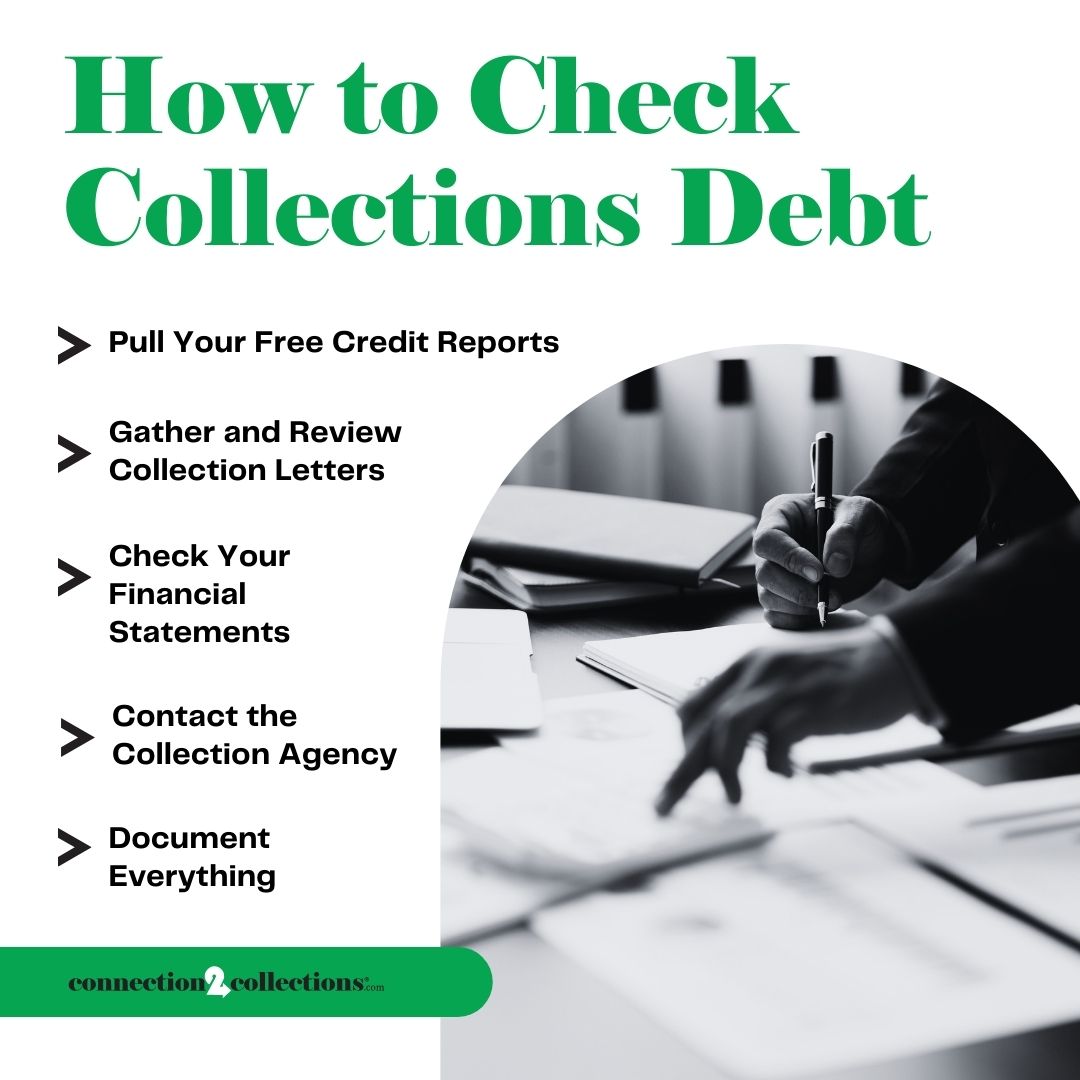

Pull Your Free Credit Reports

The first thing to do is to seek and check your credit reports. It’s the most reliable way to get a comprehensive view of your collections accounts. The best part is you don’t have to pay a dime before you can access such vital information. In fact, you’re entitled to one free report annually from each of the three major credit bureaus (Experian, TransUnion, and Equifax). After all, what is debt collection without laws like those from the consumer financial protection bureau and fair debt collection practice act guiding it?

When you do get your credit reports, head over to the “Collections” section. Therein, you’ll find the contact information plus some other details of the original creditor, the collection agency, the amount owed, and when the debt was transferred to collections. You should also pay special attention to the dates. They’re crucial to understanding your debt’s statute of limitations and how long the debt will stay on your credit report.

Gather and Review Collection Letters

Your hectic schedules may have led to missing out on useful financial information or notifications in the past. So, dig through your physical mail, email, and any documentation you’ve received about the debt. Don’t be surprised if you even come across letters from debt collection agencies. They are required by law to send you a written notice (called a “validation notice”) within five days of first contacting you.

Once you have all these letters, create a folder (physical or digital) to organize these documents. You barely have enough time as it is, so doing this will help maximize your time and save you from avoidable stress. But more importantly, having these documents in your possession may prove invaluable if you need to dispute anything or negotiate a settlement later.

Check Your Financial Statements

What are your bank balance and personal financial statements saying? Find out by reviewing your bank statements, credit card statements, and any other financial records from around the time the debt originated. This step helps you verify the debt amount is accurate. It’ll also help you spot any potential errors, payments you might have already made, or fraudulent charges. Be sure to keep copies of any statements that show payments or discrepancies.

Contact the Collection Agency

Now is the time to contact the debt collection agency listed on your credit report or collection letters. This can be via the provided phone number or email address. Scammers can pose as debt collectors. So, before engaging with any collection company, verify they’re legitimate. Conduct some research to gather as much information as possible. I’m talking about their licensing status in your state, Better Business Bureau ratings and complaints, plus online reviews and reputation.

Once their legitimacy is confirmed, request debt validation in writing. This may include proof they own the debt or have the right to collect it. They should also provide information on the total amount owed, including a breakdown of fees.

Document Everything

Having a paper trail of all your activities and collection debt research is vital. This documentation will be invaluable if you need to dispute the debt, negotiate a settlement, or prove you’ve paid. It’ll also come in handy whenever you want to file a complaint about unfair practices.

So, keep records of all communication with legitimate debt collectors, including the dates, times, and names. Make copies of letters and emails sent and received. This applies to any proof of payments you may have as well.

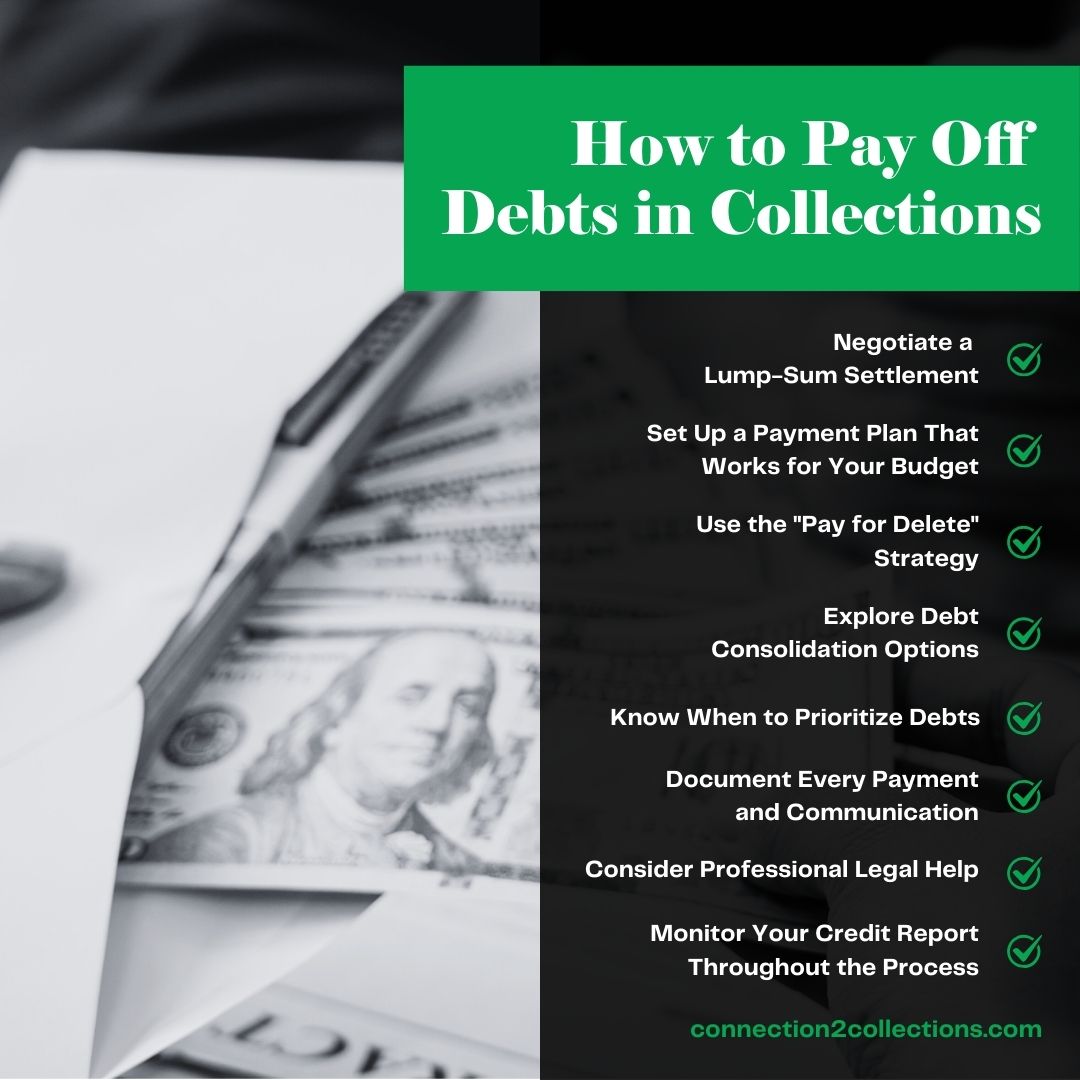

How to Pay Off Debts in Collections

Once you have a clearer view of your collection debt status and confirm the legitimacy of the collection agency, it’s time you move to the payment stage. Here’s how to tackle it head-on and clear your collections debt:

Negotiate a Lump-Sum Settlement

If you have some savings or can gather a decent amount of money quickly, this might be your best bet. Collection agencies often buy debts for pennies on the dollar, so they’re usually willing to settle for less than the full amount. To get started, start with a low offer. That means offering to pay 30–50% of the total debt. Many collectors will settle for 40–60% of the original debt amount if you can pay immediately. Just ensure you get everything in writing before sending payment. You can also negotiate removal from your credit report as part of the deal.

Set Up a Payment Plan That Works for Your Budget

Can’t pay a lump sum? No problem! Many collectors will work with you on a payment plan. Simply calculate what you can realistically afford monthly. Then get the payment plan agreement in writing. Be sure to include terms about credit reporting. You can also set up automatic payments to avoid missing deadlines. And with each payment, request regular statements showing your progress. But note: never agree to payments you can’t afford. Missing payments on a payment plan can put you in an even worse position.

Use the “Pay for Delete” Strategy

This advanced technique involves negotiating the removal of the collection from your credit report in exchange for payment. To pull this off, you start by making the offer in writing and getting their agreement in writing before paying. Once payment is made, monitor your credit report to ensure they follow through.

Explore Debt Consolidation Options

If you’re dealing with multiple collection accounts, consolidation might help. One such approach is taking a personal loan with better terms. You can then use the money to offset the most pressing bills, be it medical bills or student loans. Another approach is to explore debt management programs or look into balance transfer credit cards. This debt consolidation approach can simplify payments and potentially save money on interest. However, be sure to read the fine print carefully.

Know When to Prioritize Debts

Not all collections are created equal. So, prioritize debts that could result in legal action to avoid troubles down the road. But that’s not all. There are other types of debts that demand your attention and should be prioritized. I’m talking about accounts within the statute of limitations, larger debts affecting your credit score, and debts with the highest interest rates. This strategic approach helps you tackle the most important debts first while managing your limited resources effectively.

Document Every Payment and Communication

As earlier discussed, embracing proper documentation culture is very important. Not only does this protect you from future collection attempts, but it also proves you’ve fulfilled your obligations. So, keep receipts for all payments and save written agreements. If possible, record phone conversation details as well.

Consider Professional Legal Help

Sometimes, especially with large debts or aggressive collectors, it’s worth consulting a consumer protection lawyer for legal advice and help review your case for violations of collection laws. He can also negotiate on your behalf, protect your rights, and provide credit counseling. Even if any lawsuits show up, these attorneys are equal to the task. They will handle any lawsuits and can even advise you on bankruptcy options if necessary.

Monitor Your Credit Report Throughout the Process

This final step ensures your hard work pays off and your credit report accurately reflects your improved financial situation. Stay vigilant about your credit report during and after paying off collections. You can do this by checking for accurate reporting of payments. Also, verify when accounts are marked as paid. Watch for the removal of paid collections (if negotiated) and dispute any inaccuracies promptly. It’s also important to keep monitoring for several months after the payoff.

Getting out of collections isn’t just about clearing debt; it’s about reclaiming your financial freedom and peace of mind.

Remember, every financial setback is temporary, and with the right strategy and determination, you can overcome collection challenges. The steps and tips we’ve covered are your roadmap to financial recovery, but they’re just the beginning of your journey.

So what’s the next step? Join Connection2Collections! This is your ultimate resource for mastering the art of debt management. At Connection2Collections, you’ll get to connect with seasoned debt management experts and access proven strategies that get results. There’s also the perk of staying up-to-date on the latest collection laws and regulations, and lots more!

Visit Connection2Collections now, whether as an individual or company, and unlock the strategies that turn financial challenges into opportunities. See you there!