Can a Collection Agency Charge Interest on a Debt?

So you miss a few credit card payments. Life happens, right? Well, your once-friendly creditor suddenly decides they’ve had enough. Instead of continuing to chase you themselves, they do something interesting they sell your debt to a collection agency. Think your debt is gone? Think again!

You see, these collection agencies aren’t running a charity. They buy your debt for pennies on the dollar, hoping to collect the full amount from YOU! Yes, their business model is turning that unpaid debt into pure profit. But how, you ask? Well, they’re not just looking to collect what you originally owed, which would have yielded profits on its own. Rather, they want to add some extra spice to the financial stew. Adding interest to your debt is that extra spice!

But can collection agencies legally sprinkle it onto your existing debt? Is collecting interest a legitimate practice? Or is this just another way debt buyers squeeze more money out of already stressed consumers? What is a debt collection agency in the first place?

These are million-dollar questions that need urgent answers. That’s why, today, I’m dedicating this post to talk about whether or not a collection agency can charge interest or fees on debts.

Can a Collection Agency Charge Interest on a Debt?

Yes, collection agencies can charge interest on a debt. However, there are certain legal restrictions within which they must operate. Firstly, not all collection agencies have free rein to include interest charges. Their ability depends on several crucial factors. I’m talking about factors like state laws, original credit agreements, statutes of limitations, and even types of debt.

Each state has unique regulations governing debt collection interest. Some states explicitly permit collection agencies to charge interest, while others strictly limit or prohibit additional interest accumulation. For instance, states like California have robust consumer protection laws that restrict excessive interest charges, whereas states like Texas might have more flexible regulations.

The terms of the original contract are another important criteria. Also, different rules apply for credit card debts, personal loans, and medical bills. All these affect the legality of a debt collection agency charging interest. And perhaps the most important factor is the statute of limitations. Once passed, the debt becomes null and void.

How Much Interest Can Be Charged on a Debt?

Interest rates charged by collection agencies typically range between 5% and 10% annually. However, some aggressive agencies might attempt rates up to 18%. Nevertheless, these rates are not arbitrary, as they are governed by different regulations. These include state-specific usury laws, the original loan’s interest rate, and Fair Debt Collection Practices Act (FDCPA) guidelines, among others.

It’s also important to note that debt collectors cannot unilaterally decide interest rates. They must provide clear documentation proving their right to charge additional interest. Then, consumers have the legal right to challenge these charges. Fair and square, right?

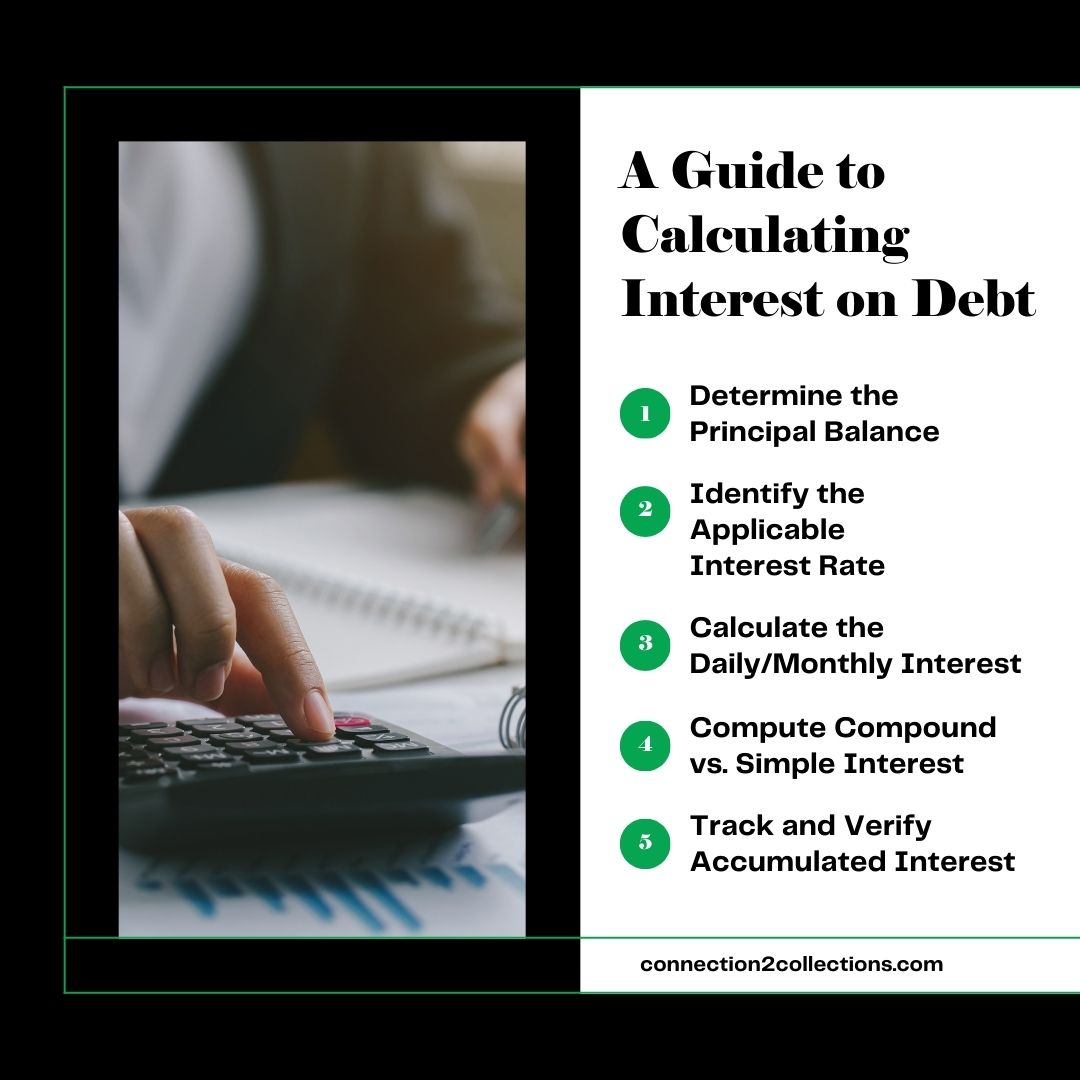

How Do You Calculate Interest on a Debt?

Collection agencies don’t always make the process transparent. As a result, consumers often find themselves scratching their heads, wondering how their original debt of $500 suddenly morphed into a four-figure nightmare. Well, below are clear steps to calculate interest on any debt:

Step 1: Determine the Principal Balance

The principal balance is the original amount of debt you owe before any interest accumulation. This serves as the foundational number for all subsequent calculations. When trying to determine the principal balance, there are certain key considerations to watch out for.

For starters, you need to verify the exact amount from your original loan or credit agreement. Then, proceed to check the most recent statement from the original creditor. You can also request a detailed debt validation from the collection agency. Finally, confirm whether a previous payment has been made that would have reduced the principal.

Step 2: Identify the Applicable Interest Rate

Not all debts accrue interest at the same rate. Your specific interest rate depends on multiple factors:

- Original credit agreement terms

- State-specific usury laws

- Type of debt (credit card, personal loan, medical bill)

- Collection agency’s legal rights to charge interest

- Statute of limitations on the debt

Step 3: Calculate the Daily/Monthly Interest

Most collection agencies calculate the amount of interest using one of two methods:

- Daily Interest Rate: total annual rate divided by 365 days

- Monthly Interest Rate: annual rate divided by 12 months

Calculation formula: Principal Balance × Annual Interest Rate ÷ Number of Days/Months = Interest Charged

Step 4: Compute Compound vs. Simple Interest

Interest calculations can follow two primary structures:

- Simple Interest: Calculated only on the principal amount

- Compound Interest: Calculated on principal plus previously accumulated interest

Understanding which method applies can significantly impact your total debt obligation.

Step 5: Track and Verify Accumulated Interest

Maintaining meticulous records is absolutely crucial. Keeping records will not only help you keep track of your debt and expenses. It’ll also come in handy when collection agencies come calling for double-checking purposes.

So, be sure to request a detailed breakdown of interest charges. Then compare agency calculations with the original agreement. Check for any illegal or excessive interest application. And should you come across any calculations that seem incorrect or excessive, proceed to dispute it.

Collection agencies operate under specific legal frameworks, and you have rights.

We all have several fundamental human rights, among which is the right to equality before the law. However, unless you know and exercise your rights, you may be taken for a ride. That’s why you need to understand how interest is calculated plus what agencies can and cannot do. Such knowledge is your best defense against potential overcharging!

Want to learn more about the complex world of debt collection? Join Connection2Collections, your ultimate resource for industry-changing collection strategies and expert insights. But that’s not all–you’ll also get to network with seasoned veterans in the field from all over the world. These benefits are just the tip of the iceberg, which works perfectly whether you are joining as an individual or company owner!

Have questions? Want to share your debt collection experience? Drop a comment below and let’s continue the conversation!