Debt Collection Officer Job Description: The Definitive Guide to a Lucrative Career Path

The debt collection industry has a bit of a reputation, doesn’t it? But like that wise saying, you shouldn’t judge a book by its cover. Why? Well, most of the bad rap this industry gets comes from spiteful debtors looking for payback after being legally forced to pay back what they owe. Meanwhile, there’s a ton of great career opportunities in the debt collection industry that many people don’t seem to know about. Trust me, I would know, seeing as I’ve been in this industry for a good number of years!

Working in the debt collection industry is never boring. You can’t help but come across different kinds of characters and personalities with each working day. There are customers who would hang up on you the second they hear your voice. Some will even try to sweet-talk you into waiving their late fees. And then there are the sneaky ones who like to play hide and seek with collection agents. Truly, there’s no dull moment in this industry!

But here’s the best part–there’s always a need for talented, hardworking debt collectors. So, if you’re looking to get into a stable, recession-proof career field, debt collection might just be the path for you. And that’s why, today, I’m going to give you the inside scoop on what it’s really like to be a debt collections officer.

Debt Collection Officer Job Description

When it comes to having a career as a debt collector, the first step is to understand what a debt collection officer actually is and what their day-to-day duties and responsibilities entail. Knowing this upfront can give you a much clearer picture of whether this type of work is the right fit for your skills, interests, and career goals!

As a debt collection officer, your primary responsibility is to recover outstanding debts owed to your employer. This could be for a credit card company, a bank, or any other organization that provides loans or services and is owed money. Your job is to contact customers or debtors, negotiate reasonable repayment plans, and ensure the original debt is paid in full.

But here’s the thing–a typical debt collector’s job description template is not all about getting into arguments and chasing people for money. There’s so much more involved. I’ll be shedding more light on a debt collection officer job description shortly!

What is a Debt Collection Officer?

A debt collector is a person who works in a company or organization for the purpose of collecting unpaid debts. Such debts can arise from sources like unpaid credit card bills, outstanding loans, utility payments, and other overdue bills. So, in its most basic sense, a debt collector is someone who comes calling when someone owes money and fails to pay it back.

Companies that offer loans, lines of credit, or other financial services often have a whole team of loan collection administrators. Their responsibility is to contact debtors and negotiate repayment terms. They use a variety of tactics to handle customer queries or evasive tactics and ensure the original debt is paid in full. It’s an essential role for maintaining a company’s cash flow and financial health.

Debt collection officers operate in a fast-paced and high-pressure environment. To excel, they need to have excellent communication skills. They must also be great at negotiating and keep their cool even when dealing with hostile or irate customers. It is by no means the easiest of picks on the job boards, but for the right person, it can be a dream career.

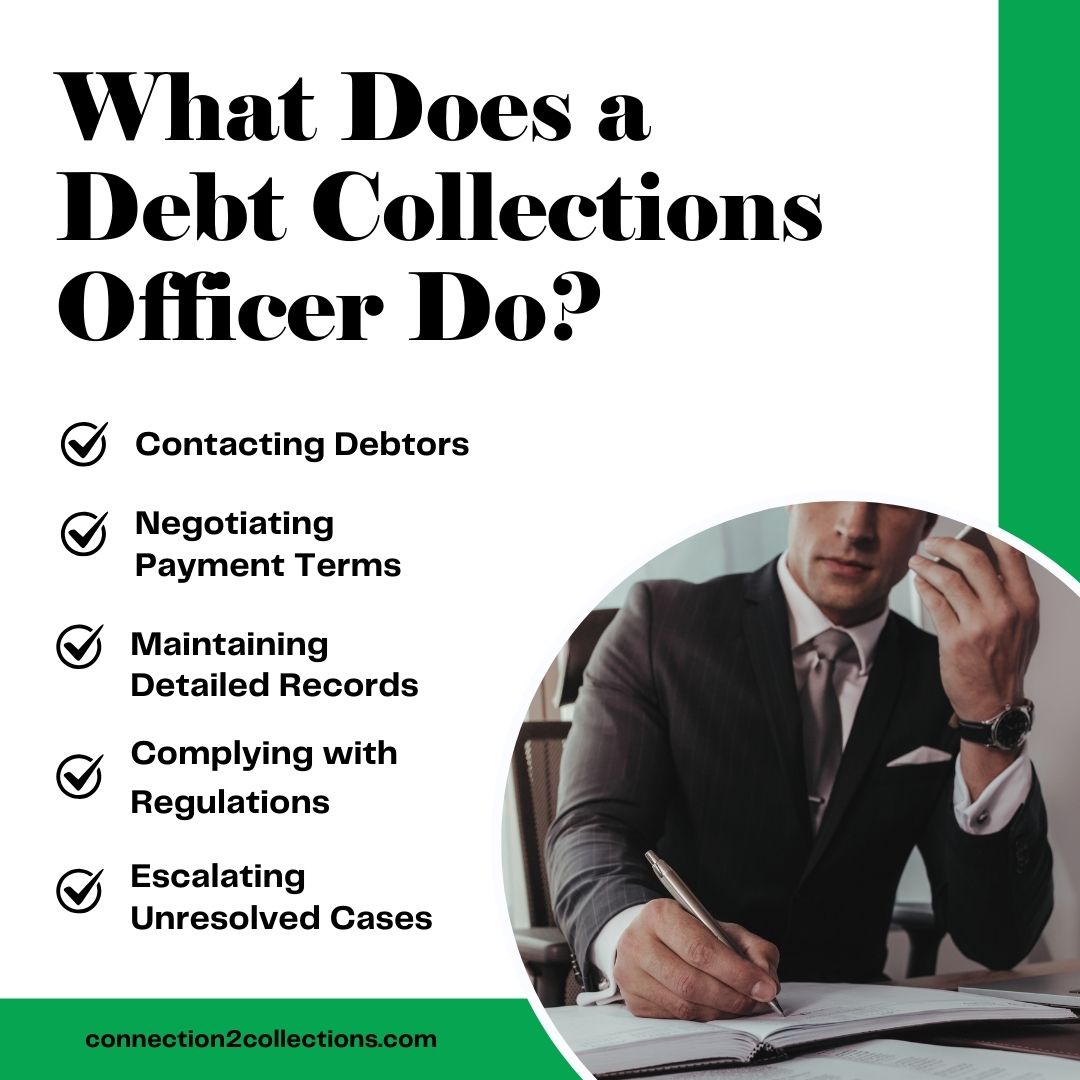

What Does a Debt Collections Officer Do?

Let’s take a closer look at the key duties and requirements that being a dent collection officer demand:

Contacting Debtors

Much of the work involves calling folks who are behind on payments and trying to get them to pay what they owe. That means making phone calls, following up with emails and letters, and sometimes even going on in-person visits. You’ll need excellent communication skills to clearly explain the situation, address any concerns the debtor may have, and persuade them to fulfill their financial obligations.

Good telephone manners and being able to keep calm under pressure are a must. Debt collection can be an emotionally charged process, so you’ll have to learn how to have difficult conversations without escalating the situation. You will need active listening skills, empathy, and conflict resolution strategies.

Negotiating Payment Terms

Once you’ve made contact with a debtor, the next step is to negotiate some sort of repayment plan. This means you’ll need to analyze the person’s financial situation. In doing so, you need to take into account factors like their income, expenses, and overall ability to pay. The goal is to come to an agreement that works for both the debtor and your employer.

You must have strong negotiation and problem-solving skills to ace this requirement. You’ll need to be able to persuade the debtor to uphold their end of the bargain while also being willing to compromise when appropriate. Having a creative-thinking and solutions-oriented mindset helps greatly.

Maintaining Detailed Records

Put simply, collecting debt is a heavily documented process. This means you’ll be required to keep meticulous records of all your interactions with debtors. For instance, this could mean keeping a record of every phone call, email, and letter you receive from the debtor. It also means documenting any agreed-upon payment plans or other arrangements.

Good organizational skills and attention to detail are a must. You should also be highly skilled in credit tracking software and databases. This aspect of the job can use strong computer literacy, data entry skills, and written communication abilities.

Complying with Regulations

The debt collection sector is subject to a great deal of regulation. There are a number of rules and regulations that must be obeyed by creditors, debtors, and even collectors. As a debt collection officer, you’ll need to be well-versed in these regulations and ensure you’re always acting in compliance. This might involve things like adhering to fair debt collection practices, respecting the rights of debtors, and documenting all interactions.

You must know the applicable laws and be able to apply them across all types of situations. You should also be able to explain these regulations to both your employer and the debtors you’re working with. Those with a strong background in research and analytics are more likely to be successful with this step.

Escalating Unresolved Cases

There will also be some situations where a debtor is uncooperative or simply unable to pay off their debt, and nothing can really change that. In that event, you may have to escalate the case. I’m talking about hiring a debt collection agency, charging your debtor to court, or something else.

This is a delicate process that requires careful documentation and a firm grasp of the appropriate procedures. The post “What is a Debt Collection Agency” can provide more insight on choosing to escalate through the collection agency route.

Here, critical thinking, problem-solving, and sound judgment play key roles. You will have to look into every situation objectively. Then, you’ll need to weigh the available options and make the best decision for your employer. You should also have strong organizational and time management skills since you’ll be juggling multiple unresolved cases at once.

Being a debt collection officer is a multi-faceted role that requires a diverse set of skills and competencies.

Being a debt collection officer is a tough task for sure, but it’s equally rewarding and a lucrative career path. Debt collection helps keep several businesses financially healthy. Therefore, any strategic business owner will seek to always have talented, ethical debt collection professionals on its payroll.

So, if you’re intrigued by the prospect of becoming a debt collection officer, I encourage you to explore the opportunity further. Professional debt collectors are in high demand by countless companies that need help recovering outstanding debts and keeping their cash flow strong.

So what’s the next step? Sign up with Connection2Collections, whether as an individual or company! This is your definitive guide to learning the basics of debt recovery and everything the industry has to offer. As a member of the Connection2Collections platform, you’ll get to connect with industry veterans and learn about what actually works. There’s also the added benefit of keeping you up-to-date on new collection laws and regulations, among several other benefits! See you there!