Debt Collection Paralegal Job Description: Breaking Down Key Responsibilities That Drive Recovery Success

The debt collection world is not your typical 9-to-5 gig. It’s an industry that never sleeps and probably never will. And as long as folks continue to swipe their credit cards, this industry isn’t going anywhere. It’s an industry on fire and has some serious career potential.

Think about it–we’re living in a time when the economy’s running largely on credits, and financial obligations are as common as coffee shops. Nearly everyone has a credit card, loan, or payment plan to cater to. As such, there’s no shortage of outstanding debts waiting to be recovered. So, it’s unsurprising that debt collection agencies and law firms have a constant need for skilled professionals.

Having witnessed the evolution of our industry, I can tell you that one role, in particular, has become increasingly crucial: the debt collection paralegal. However, not many people are aware of what the role of a debt collection paralegal entails. They assume the debt collection industry is only about sending emails or ringing debtor’s doorbells. Consequently, they miss out on multiple amazing career opportunities this industry has to offer!

That’s why today I’m going to talk about the debt collection paralegal job description. Let’s get into it!

Debt Collection Paralegal Job Description

Remember the saying, “Information is power?” Yeah, that’s right! The same applies to different roles within the collection industry. Lack of information is why most people have different misguided notions about the debt collection industry. Lack of information is also why many people are missing out on great job opportunities within the industry. Well, that ends today!

Today, I’ll be empowering you with detailed information you can leverage to boost your career in the debt collection industry. But before we dive into the nitty-gritty of job requirements and daily tasks (don’t worry, we’ll get there), let’s set the stage for what you’re about to discover.

Shortly, I’ll be unpacking everything you need to know about what debt collection is and the roles of paralegals in it. We’ll explore the essential skills, responsibilities, and even qualifications that make a debt collection paralegal worth their weight in gold. By the end, you’ll have a full understanding of the role so you can make an informed decision on your next step career-wise.

What Is A Debt Collection Paralegal?

Debt collection paralegal is a special breed in the collection industry. Nearly everyone knows that the regular debt collector’s job duties are to spend their days making calls and sending letters. There are also collection lawyers who handle court appearances and legal strategies. And then there are paralegals, the behind-the-scenes heroes who keep the whole operation running smoothly!

Debt collection paralegals are crucial to successful debt recovery. They essentially serve as a bridge between debt collectors and attorneys. While debt collectors focus on direct communication with debtors and attorneys handle the heavy legal lifting, paralegals are the ones preparing legal documents, conducting research, managing case files, and ensuring everything is compliant with state and federal regulations.

However, you can’t just wake up one day and automatically start practicing as a collection paralegal. Unlike debt collectors, paralegals have to undergo specialized legal training. Note that this doesn’t mean you need a full law degree like attorneys do. Rather, it’s to ensure you have adequate knowledge of the legal side of things and be able to fly solo without troubles if needed. That means having a full understanding of legal procedures, being able to draft legal documents, and knowing your way around a courthouse.

Thanks to their training, paralegals can boast of multiple competencies and skills. While debt collectors might be great at negotiating payments and lawyers excel at arguing cases, paralegals are masters at handling both the administrative and legal aspects of debt collection. They organize cases, prepare legal documentation, and keep everything moving forward according to legal protocols. They’re the ones who ensure that when your firm decides to take legal action, every ‘i’ is dotted and every ‘t’ is crossed.

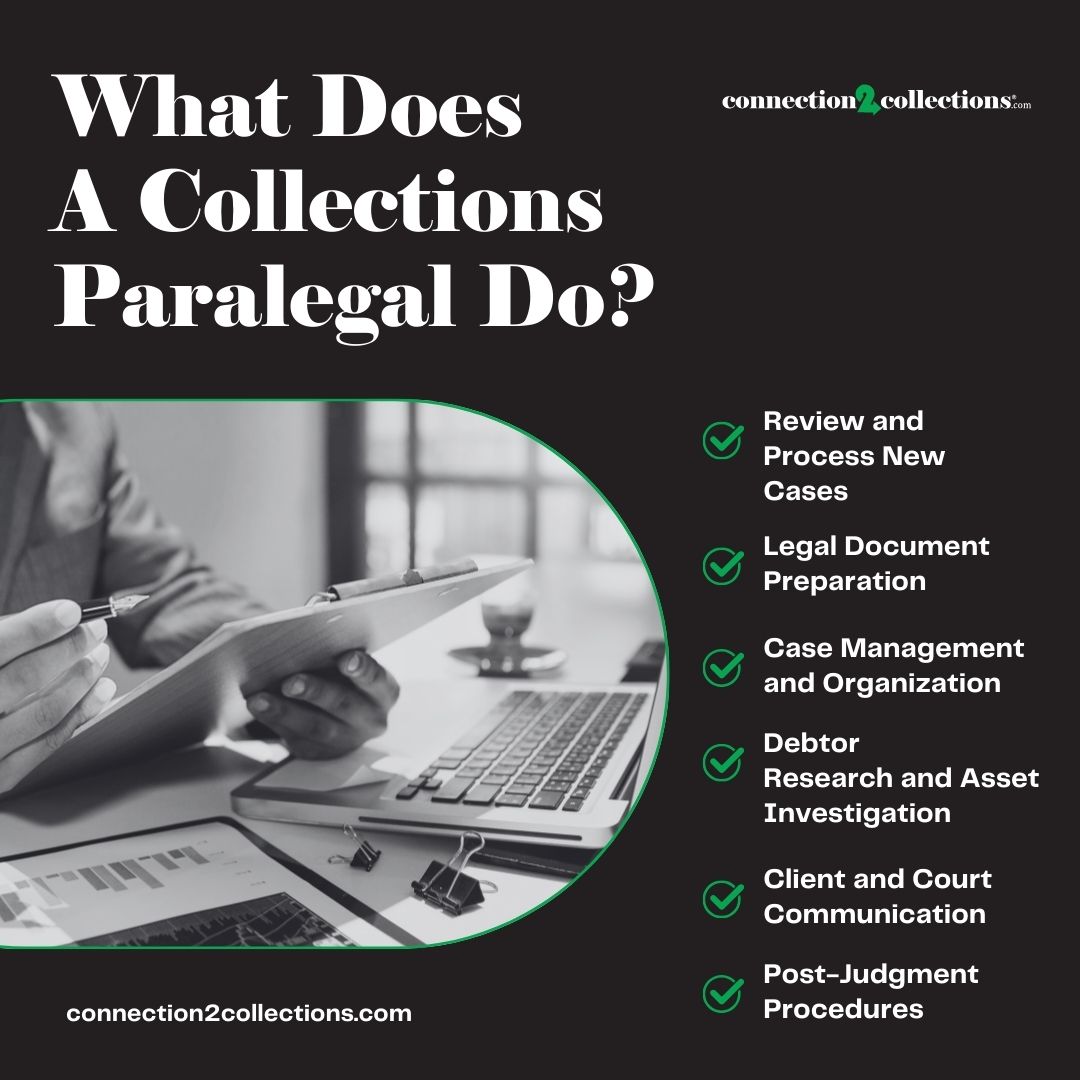

What Does A Collections Paralegal Do?

If you think a collections paralegal just pushes papers around and makes coffee runs, you’re in for a surprise. These professionals are the backbone of any successful debt collection legal operation, juggling multiple responsibilities that require both legal expertise and killer organizational skills. Let’s discuss the core duties that make them invaluable team members:

Review and Process New Cases

Like a detective piecing together a puzzle, collections paralegals are the first line of defense in evaluating new cases. They sift through client information, debt documentation, and financial records to determine if cases are worth pursuing legally. They’re experts at spotting red flags, identifying promising cases, and knowing which debts have the highest likelihood of recovery. This initial assessment can save your firm thousands in wasted time and resources.

Legal Document Preparation

Collections paralegals are also the maestros of legal paperwork. They prepare and file complaints, summonses, motions, and judgments with the precision of a surgeon. Think this is just boring paperwork? Think again. One minor error in these documents could derail an entire case and cost your firm both time and money. These pros ensure every document is airtight and ready for court.

Case Management and Organization

Remember that feeling when you finally organized your garage? That’s what collections paralegals do for your cases, but at a much higher level. They maintain detailed case files, track deadlines, manage court dates, and keep everyone in the loop. Without their organizational prowess, even the best attorneys would be swimming in a sea of chaos.

Debtor Research and Asset Investigation

Collections paralegals dig deep into public records, databases, and financial documents to locate debtors and their assets. They’re experts at finding those needles in the haystack. These may include bank accounts, properties like real estate, employment information, or any other assets that could be used to satisfy a debt. This investigative work is crucial for determining whether pursuing a case is worth the investment.

Client and Court Communication

These professionals are the diplomatic liaisons between your firm, the courts, and your clients. They handle routine correspondence, update clients on case status, and maintain relationships with court personnel. Think of them as your firm’s ambassadors. They keep the wheels of communication turning smoothly while maintaining that crucial professional image. Their ability to communicate effectively can make the difference between a satisfied client and a lost account.

Post-Judgment Procedures

Once you’ve won a judgment, the real work begins. Collections paralegals coordinate with sheriffs for property seizures, prepare wage garnishment documents, and monitor payment plans. They’re the ones who turn those legal victories into actual recoveries. Without their follow-through, even successful judgments could sit collecting dust instead of collecting money.

Skilled collections paralegals are the unsung heroes of the collection industry who transform legal strategies into tangible results.

Debt collection paralegals are the glue that connects important operations together. These legal assistants keep your operation running smoothly like a well-oiled machine while ensuring every action stays within legal boundaries. As such, starting a career as a collection paralegal is a lucrative, highly rewarding, and makes you an important figure in the organization. After all, every collection agency owner knows that having a competent collections paralegal could be the difference between merely surviving and truly thriving in this competitive industry.

Want to learn more about the different areas of the debt collection industry you can leverage and maximize? Then join Connection2Collections today! Joining this platform will help grant you access to a network of industry veterans, expert insights, and proven strategies that can revolutionize your approach to debt recovery.

Our platform connects you with seasoned professionals who understand the intricacies of debt collection inside and out, be it as an individual or company owner. Whether you’re looking to hire top-tier paralegals, expand your knowledge base, or stay ahead of industry trends, we’ve got you covered. See you there!