How to Improve Your Negotiation Skills as a Debt Collector

Let’s face it: getting one’s money back is always a challenge, whoever the debtor is. But here’s the hard truth: Even though the debt collection industry is sometimes complicated it ensures the continuity of business. It’s the same as the car engine oil; it may not always be pretty or even invisible at times, but a car can’t do without it.

Now, this isn’t just about going after a handful of clients, customers, leasees, etc. who have not paid what they owe. Rather, it’s more about being armed with all the needed skills and know-how to boost your chances of success. So, what exactly is this important skill?

The secret key in this financial tug-of-war is not a shiny gadget or a magic crystal ball. Nope, it’s something way cooler: your negotiation skills! The better you get at negotiating, the more likely you are to reach an agreement and rake in those elusive dollars.

When you can negotiate effectively, you are not only recovering debts. You are building bridges, resolving conflicts, and possibly even turning a stressful situation into a positive experience for everyone involved. Sounds pretty good, right?

Unfortunately, learning to champion such successful negotiations during debt collections is not an easy task. That’s why I’m sharing this guide on how debt collectors can improve their negotiation skills. With some practice, you’ll soon nail it down.

Successful Debt Collection Requires Negotiation

In this line of work, debt collectors are not just people who count numbers or endorse a bill. You’re a problem solver, a mediator, and sometimes a personal financial advisor. When you are equipped with an effective negotiation strategy, you won’t only recover debts. You’ll also foster improved interpersonal communication, thereby improving your well-being (through stress reduction) and the welfare of the debtor in question. As a bonus, you may even help the latter get back on their feet financially.

It gets better these body language, role playing, and communication skills required to handle important negotiations will make you a better professional. It can further fast-track securing promotions, increased salaries, and more. Who doesn’t want that?

Why Do You Need Negotiation Skills as a Debt Collector?

What makes debt collection work even more challenging is the fact that the person on the other end of the line is typically under pressure. They may be feeling ashamed and possibly do not want to speak with you. If you don’t have good negotiation processes and skills to leverage, your conversation can turn sour in less time than it takes for an ice cream cone to melt.

Knowing some key negotiation skills comes in handy in times like this. They’ll help you manage your anger and transform that energy into convincing the debtor to pay up.

Good negotiation tactics help with:

- Building rapport: When you can identify with somebody, there are greater chances that he or she will cooperate with you. It’s human nature.

- Understanding the whole picture: It is possible they have some reason they can’t pay, which is not apparent from the surface.

- Creating win-win outcomes: You don’t go with the idea of forcing yourself on someone. It is more like searching for the middle ground, for a solution that will be satisfactory for all the interested parties.

- Aligning with reality: To be very honest, there are times when the debtor simply has no ability to meet the owed payment. Your skills can help determine what they are capable of handling.

- Reducing stress: This is in your best interest and that of the debtor. With good negotiation and communication skills make your dialogue less confrontational. It makes the task less physically stressful and less mentally draining.

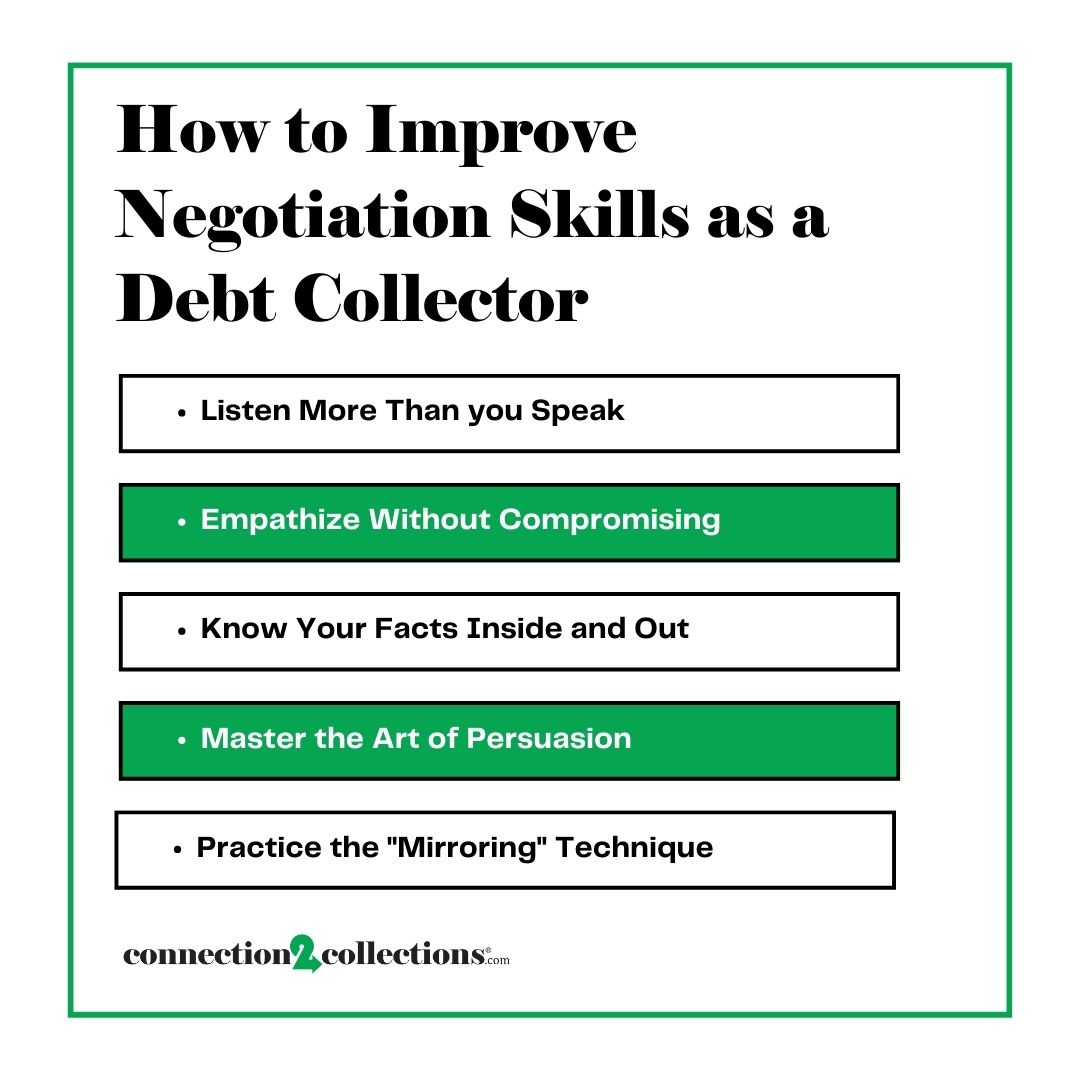

How to Improve Your Negotiation Skills as a Debt Collector

Negotiation is one of the most important aspects of debt collection. It needs to be handled well to achieve the desired results. However, these negotiation skills are not only meant for recovering debts. Good negotiation strategies also ensure debtors do not feel frustrated when paying their dues.

Here are some key steps you can take to improve your negotiation skills:

Listen More Than you Speak

You know how we have two ears but only one mouth? Well, it’s believed to insinuate that listening is more important than speaking. Well, in the world of debt collection, something like this couldn’t be closer to the truth! If conversation is like a game, then listening is the hidden card to uncovering valuable information.

While on a call with the debtor, avoid full-scale engagement. Instead, approach the conversation with an intent to listen and absorb all the information that they are willing to offer.

Are they hinting at a recent job loss? Did they mention unexpected medical bills? Some of this information is golden, which is fitting for developing the right solution.

Use active listening skills and techniques. Repeat key points back to the debtor to show you’re really listening. If present physically, maintain eye contact, nod your head along, and show concerns. These actions are like a non-verbal affirmation that you’re not merely listening to them but also understand their plight.

Empathize Without Compromising

Now, don’t think that you are actually going for the ‘world’s best friend’ mug here. But catching a debtor in a moment of weakness and offering the tiniest bit of understanding that can change her world can help change the mood and behavior drastically.

Try to put yourself in their shoes for a moment. They may have a lot of expenses or outstanding loans, or they may have a family problem or something like that. However, understanding their situation does not mean that you will turn a blind eye to their debt. It should, in fact, be the stepping stone for a warm and productive conversation.

Here’s the trick: Balance empathy with discipline. You might say something like, “I know you are having some issues, and I want to help find a solution that works for both of us.” See what I did there?” I acknowledged their struggle while still keeping the focus on resolving the debt.

Know Your Facts Inside and Out

Picture this: You are in the middle of a negotiation with a debtor, and suddenly, he asks you something like, ‘Can you tell me more about my account?’ If you are handling questions blindly, then you may not be able to provide a convincing answer. This won’t do your odds for successful negotiation any good.

Before you decide to call this person, ensure you gather as much information as possible. Have all the details about the exact debt, payment record, prior meetings and discussions, and anything related to the account.

Why is this so crucial? Well, being well-informed does not only give you confidence but also help in responding to any questions or rebuttals swiftly. Moreover, it will help to demonstrate to the debtor that you are keen on addressing the issue.

Master the Art of Persuasion

Persuasion should not be associated with manipulation, and the commonly accepted objective of persuasion is not one of deception. They differ most fundamentally in how options are presented to the other party. Persuasion incentives with the intention of emphasizing real-life gains that the debtor would appreciate.

For instance, instead of using stern words such as ‘You must pay this debt NOW,’ use phrases such as ‘You should make payment plans to avoid incurring interest and start rebuilding your credit score.’ You’re not just demanding payment; you’re showing them how paying benefits them.

Practice the “Mirroring” Technique

Well, I’m not suggesting you practice your poses in front of the bathroom mirror (even though I’m not against a boost in confidence). This technique is as simple as mimicking the debtor’s pitch, tempo, and even the choice of words.

If they speak slowly and softly, do not approach them as if you are an auctioneer who has been given a basket of eggs to sell. Match their energy. If they use some specific phrases often, you may use the same phrases in your responses.

For example, if they are constantly referring to the fact that they are ‘stuck,’ you can use that kind of language too: ‘I understand that you’re stuck, but let’s try and find a way out of this fix.

This technique fosters a relationship on a level that may not be so apparent but is effective all the same. Soon enough, they’ll feel like you’re both on the same wavelength, making them more likely to cooperate.

In the world of debt collection, knowledge isn’t just power; it’s money in the bank.

Mastering the art of negotiation is not something that can be achieved in one or two days. It requires time, commitment, and possibly the first few calls ending as a complete waste of your time. However, know that all those efforts will be well-worth it in time.

Now that you know how to level up your negotiation skills, the next step is joining the Connections2Collections family!

Connections2Collections is the ideal platform for people in the debt collection industry. It’s a great environment where not only job vacancies are posted, but also, experienced professionals are present and ready to help you go up that career ladder.

It’s easy to get started, as long as you have an internet connection. Within a few minutes, your account will be up and running. Whether you are a job seeker in search of that perfect job opportunity or an employer seeking the right talent suited for your company, you’ll be sorted here. You can also find mentors, get people to recommend you, or become an expert who gets highly recommended.

See you there, and good luck in your negotiations!