How To Start a Debt Collection Agency: A Quick Overview

Like any new business venture, starting your own debt collection agency can be quite exciting. Not only do you get to be your own boss, but it’s also an opportunity to do a lot of good for society. How? I’m talking about helping businesses stay alive through the collection of debts owed. Thanks to debt collection companies who are keeping the wheels of our economy moving, there’s hope for businesses in financial distress!

Being the lifeline to which business can hold on to is sweet perhaps heroic. But, starting your own collection agency is by no means a walk in the park. The process entails jumping through some delicate legal hoops, keeping certain ethical considerations in mind, and finding a perfect balance between being firm in your demands and being empathetic with debtors.

Why am I telling you all this? Well, I know lots of people are excited about the prospect of entering the debt collection industry as an agency owner. However, many are faced with the daunting question, “Where do I even begin?” That’s why I’ve put together this guide to show you how to start a debt collection agency!

How To Start a Debt Collection Agency: A Quick Overview

Without further ado, let’s get into the exact step-by-step steps of starting your own debt collection agency:

Step 1: Research and Planning

Proper preparation, they say, prevents poor performance. Do you want to be successful in starting your own agency? Then, you’ve got to do your homework well. Doing proper research and planning will serve as a robust cornerstone of your business. Everything else will be built upon it.

How can you do this? Start by doing thorough research on everything there’s to know about the debt collection industry. One of the best resources to gather valid information is Connection2Collections. What’s currently trending on social media? Who are your potential competitors? What niches seem underserved? The answers you find will serve as a compass on your journey.

Next, use the information you’ve gathered to develop a comprehensive business plan. I’m talking about your potential business structure, financial projections, marketing strategies, and operational procedures. Then, who is your target market? Also, what will you be focusing on? Is it the recovery of medical debts, credit card company debts, or perhaps business-to-business collections? What about your collections processes and strategies? Know exactly what you’ll be doing. This won’t just give you a direction to focus on but also get you better prepared to face the challenges ahead.

Check out this post: “What is a Debt Collection Agency?” for more information on what a collection agency actually does.

Step 2: Legal Compliance and Licensing

With a solid plan in place, we now have to ensure that you are not on the wrong side of the law. Debt collection is a highly regulated field, and for good reason. You’ll need to familiarize yourself with the Fair Debt Collection Practices Act’s (FDCPA) laws and regulations. The same goes for any other laws pertaining to your state.

Then, obtain all the licenses and permits required in your field. This may be a general business license, and, depending on the state you are in, you may require certain debt collection licenses. Don’t even think about skipping this step. Many businesses have been slapped with heavy fines or even shut down for operating without the relevant licenses.

You may also want to seek the services of a legal attorney who specializes in debt collection law. This may seem like an extra expense, but think of it as an investment your agency’s business cards don’t become useless in the future. They can help you stay fully compliant from day one.

Step 3: Set Up Your Business Structure

Now is the time to make everything official. For starters, you’ll need to decide between the different types of business structure (that’s if you skipped it in step 1). This could mean operating as a sole proprietorship, partnership, limited liability company (LLC), or corporation. Just make sure you think it through because they each have their own pros and cons. I’m talking about liability protection, taxes, and operational flexibility.

Once you’ve made your mind up, choose your business name and apply for an Employer Identification Number (EIN) from the IRS. This step is important for taxation issues. It’ll also be of future importance when you want to employ workers.

Opening a business bank account is another important task to check off your to-do list. Don’t mix your personal and business finances. This is not only wise but essential for accurate record-keeping and, in some cases, legal reasons.

Step 4: Develop Your Technology Infrastructure

Your attitude towards technology in this digital age can make or break your business. Most businesses today have already gone digital, and so must yours. You’ll need robust software to seamlessly handle accounts, payments, credit reporting, and legalities. To fully maximize technology in your business, look for a system with such options that offers features like automated payment reminders and detailed reporting. It’s best if the tools or software are compatible with other financial applications.

Another important thing is investing in a secure, reliable phone system. Most of your communication will be done over the phone, so crystal-clear communication is essential. For instance, you may want to consider a Voice over Internet Protocol (VoIP) system to grow your business.

Security is also very crucial in this industry. And given that lots of the operations are done through the internet, cybersecurity is non-negotiable. You’ll be handling sensitive financial information, so be sure you have robust security measures in place. Doing this will not only secure your clients’ information but also protect your company and build trust.

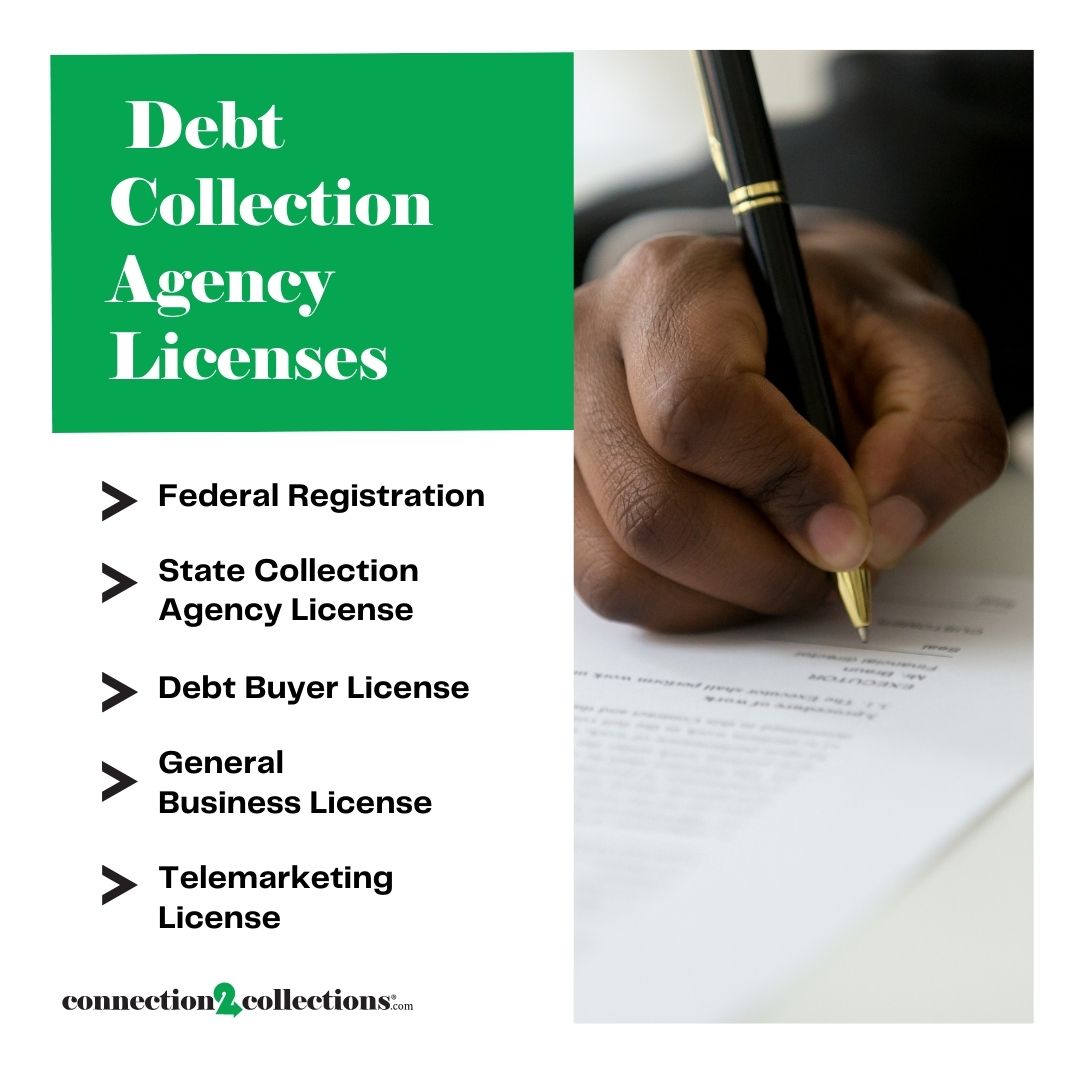

Must-Know Debt Collection Agency Licenses

Both the state and federal governments are constantly monitoring everything that happens in the debt collection industry. Top on the list of boxes to check with the government are the different licenses at various levels. Get the required licenses, and you are spared from avoidable legal headaches. Plus, your customers will feel protected, trust in you more, and boost your company’s reputation.

Below are the key licenses you’ll need to operate legally and ethically in the debt collection space:

Federal Registration

First things first, you’ll need to get yourself on the federal government’s register by registering your business. This isn’t a license in the usual sense. Nevertheless, it’s a basic requirement for anyone seeking to operate as a debt collector. To do this, you can visit the website of the Consumer Financial Protection Bureau (CFPB). Then, provide some details about your business, contact information, and agree to comply with federal regulations. And that’s it! Completing this CFPB registration grants you the golden pass to operate across state lines.

State Collection Agency License

Here’s where things get a bit more complex. Debt collectors are also regulated by most state laws, which demand they acquire a specific collection agency license to practice in a given state. The requirements may also differ from one state to another, so you’ll need to do your homework.

Getting a state license is usually achieved by filing a form, paying a certain amount of money, and, maybe, passing a test. Some states may also ask you to provide a surety bond. This is essentially an insurance policy to protect consumers.

To get started, consult your state’s regulatory body; this is most likely the Department of Financial Services or an equivalent. Note that the number of state-based licenses you’ll need may rise depending on how many states you plan to operate in.

Debt Buyer License

This debt collection license will be needed if you plan to go beyond just collecting debts. I’m also talking about buying debt. Some states even issue separate licenses for each activity to distinguish between debt collectors and debt buyers.

The steps to apply for a debt buyer license are similar to those for a general collection agency license. However, the requirements for the former tend to be more stringent. For instance, obtaining a debt buyer license often entails higher bond amounts and more detailed financial disclosures.

General Business License

This one is compulsory to have aside from special licenses that apply to your line of business. Without a general business license, you can’t conduct your business legally. Applying for this license is usually done at the local level. I’m talking about going through your city or county government.

The process is usually straightforward fill out an application form, pay a commission, and that is it. However, there may be additional requirements in some localities. So, be sure to check with your local government office before proceeding.

Telemarketing License

Since most of the debt collection involves the use of a telephone, you might also need a telemarketing license. This is particularly true if you’re making outbound calls with the aim of recovering some outstanding debts.

The Telephone Consumer Protection Act (TCPA) regulates telemarketing calls, including debt collection calls. This one is also not a license per se. But, you still need to ensure you’re not violating any of the TCPA rules. This ranges from registering your phone number with the National Do Not Call Registry to.

Some states have other telemarketing rules and regulations that apply to them. For example, to engage in telemarketing in Florida, you need to secure a separate license. To be safe, check your state’s requirements to ensure full compliance.

Starting a debt collection agency is a journey that requires careful planning, legal diligence, and a commitment to ethical practices.

Yes, the road to successfully starting a successful debt collection agency may seem rocky. Nevertheless, the payoff for having a solid plan beforehand is enormous. Just know that success in this industry doesn’t only mean collecting debts successfully. Building relationships, maintaining your integrity, and promoting a healthy economy are just as important.

Thinking about advancing your debt collection business career? Don’t go it alone! Be a member of Connection2Collections now and unlock a world of opportunities for yourself. This platform is for both individuals looking to sharpen their skills and companies aiming to expand their network. Wherever you belong, Connection2Collections will provide you with all the tools and resources to help you thrive!

When you join, you’ll gain access to the best practices, latest trends, and cutting-edge insights. You’ll also get to network with a community of professionals who understand the unique challenges and opportunities of debt collection. So, join Connection2Collections now and position yourself at the forefront of the industry. See you there!