Is Debt Collection a Good Job for Aspiring Finance Professionals?

Let’s face it, when most people think of debt collection, they imagine a stress-filled pressure cooker of a job. You know, the type where you’re on the phone all day yelling at people who refuse to honor past agreements and pay their bills. Not exactly the material of childhood career aspirations, is it?

But get this: despite all these ‘dirty’ stereotypes, more and more individuals are proactively looking for a role in debt collection. Surprising, right? It’s got me wondering, What’s the real story here? What are these people seeing that others might be missing?

And so for today’s post, I have decided to demystify debt collection as a career choice. Is debt collection a good career or not? What can you expect as a debt collector? Let’s find out!

Is Debt Collection a Good Job for Aspiring Finance Professionals?

This post looks at debt collection as a career opportunity. First, we will begin with a basic explanation of what debt collection actually comprises (and let me tell you, there is a lot more to it than just making phone calls and sending intimidating letters). In this guide, we are going to look at what the day-to-day job of a debt collection agency entails and how to succeed as a collector. We’ll also examine the problems that can arise.

But we won’t stop there. We will also get into the nitty-gritty details that can actually help you determine whether or not this career path is a fit for you. I’m talking about things like salary packages, job security, and future possibilities for growth. By the time we’re done, you’ll have a clear picture good and bad of what life as a debt collector is all about.

What is Debt Collecting? A Quick Overview

In the crux of it, debt collection is the practice of chasing debts from people or businesses. But trust me, it is a lot more than just asking people for money.

Basically, debt collector job duties are like financial detectives. They perform the difficult duty of hunting down debtors, validating debt information, structuring payment plans, and yes, sometimes dealing with people who are less than thrilled to hear from them. It’s a demanding role that requires two almost opposing traits in one the tenacity to get debtors to eventually pay up while also having empathy for what they are going through.

Debt collection is exciting in so many ways. Firstly, no two days are ever the same. Each day is always a head-scratcher, be it trying to find out where an elusive debtor has holed up or working out a payment plan that suits both the creditor and the debtor. It’s a job that keeps you on your toes.

But to be honest, it can also be hard. You have to deal with people who are going through tough times, and that can be emotionally taxing. You need to be able to maintain your composure in the face of frustration or anger. And you also need to be knowledgeable about the debt collection laws, which are extremely convoluted and different in every single state.

However, the rewards are often worth the challenges for most debt collectors. Resolving a long-standing debt or helping someone find a way to meet their financial obligations is genuinely satisfying. It’s a job where you can make a tangible difference both for your clients and for the people you’re collecting from.

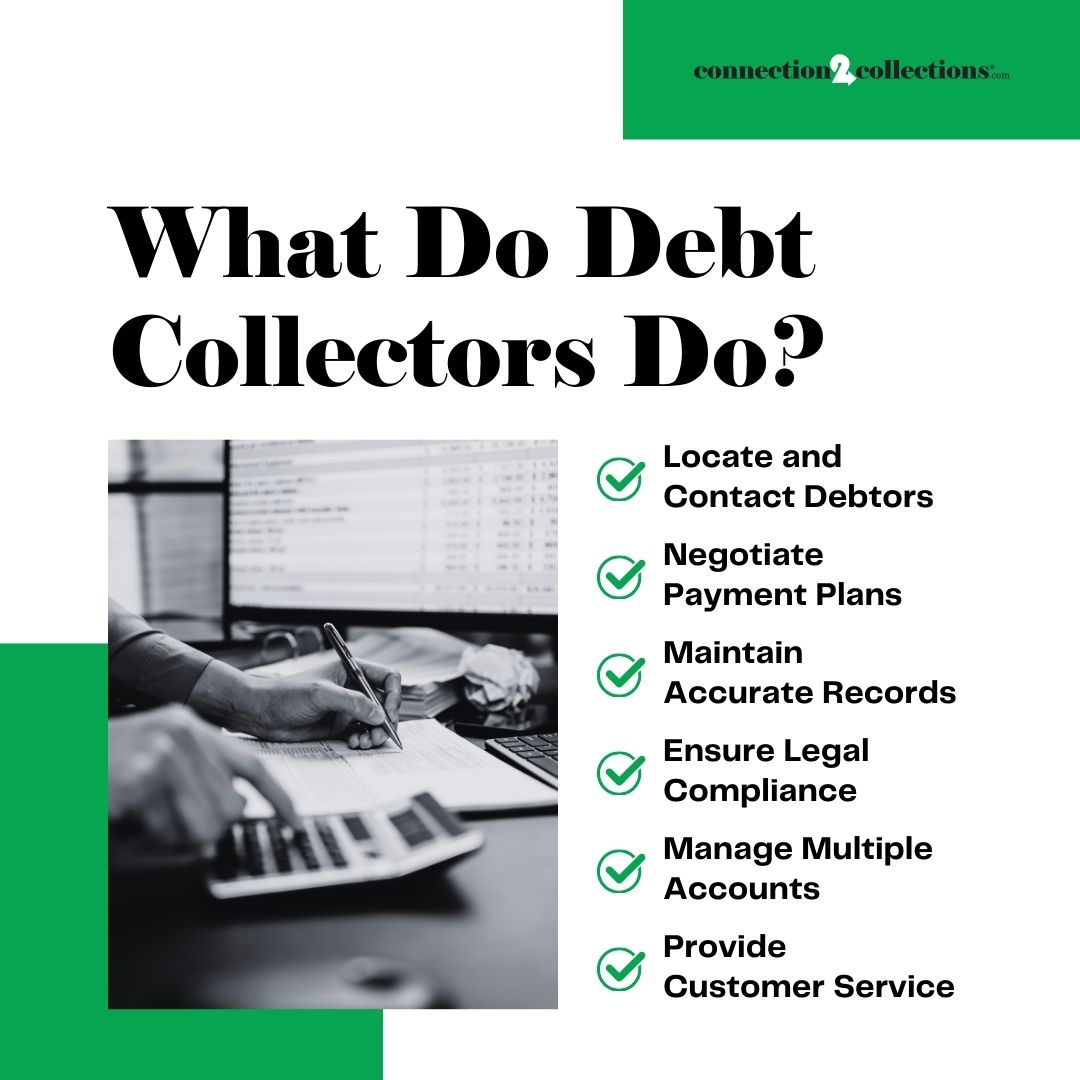

What Do Debt Collectors Do?

Below are the various responsibilities of debt collectors and the skills required to excel in this challenging profession:

Locate and Contact Debtors

Debt collection agencies use different means to find defaulters. This includes using public records, some skip-tracing, and social networking tools. The investigative aspect of this task can be like solving a puzzle. Every case is different and provides its own trials, which can make the job engaging as well as stimulating. Persistence and good research skills are vital here.

Negotiate Payment Plans

Collectors can set up reasonable repayment plans with the debtor once contact is established. Collectors have the opportunity to assist people in finding ways out of their debts and possibly improving their financial situation. It needs a combination of an analytical mindset with people-management skills. You also need good communication and negotiation skills, empathy, and financial literacy.

Maintain Accurate Records

For compliance purposes and to recover more debts effectively, proper documentation of each interaction, payment agreements, and collection efforts is important. This can be quite satisfying for those collectors who enjoy being structured and organized. It further gives a clear picture of progress and helps in planning follow-up efforts. You should be attentive to details, good with numbers, and organized.

Ensure Legal Compliance

There are many consumer protection laws, such as the Fair Debt Collection Practices Act (FDCPA), that debt collectors will have to follow in order to protect their rights and stay out of legal trouble. Things change and they do so often in debt collections. Debt collection laws come with an extra layer of complexity that makes it intellectually stimulating. Hence, it’s important you’re familiar with all laws pertaining to the collection of debts and ethical decision-making.

Manage Multiple Accounts

Collectors normally work on several cases at a time and may choose which accounts to pursue based on things like the age of the debt or the likelihood of recovery. With numerous accounts at a time, it keeps your brain intrigued and makes tasks challenging. It also allows collectors to develop strong organizational and strategic thinking skills. Time management, multitasking, and prioritization skills are key here.

Provide Customer Service

Even as their work can often be adversarial, debt collectors are still expected to excel at customer service with the debtors they call. If you love helping others, then this part of the job could be interesting for you. It provides opportunities to take a crap situation and turn it into a win. However, you’ll need to be patient, emotionally intelligent, and possess good conflict-resolution skills.

How Much Do Debt Collectors Make?

As of 2024, an average debt collector gets paid $17.45 per hour and $39,980 total per year in the US.

There are a few components that can significantly influence the earnings of a debt collector. Experience is one. As is the case in just about any other industry, the longer you’ve been in the game, the more you’re likely to earn more.

Another common feature of debt collection jobs is incentive-based pay. You’re rewarded with bonuses or commissions based on the amount of debt you collect.

Job location also impacts salary ranges. Urban areas and regions with a higher cost of living tend to offer better salaries. How much you earn may also depend on your industry. For instance, collectors of medical debt or government debt may be earning more money than those working in consumer debt.

Is Being a Debt Collector a Good Job?

I believe debt collection makes for a good career, especially if you have the stomach to deal with rude debtors every day. If you’re a natural problem solver who’s great with people and has no issues keeping your cool, you might find this career very satisfying.

However, the question of whether debt collection is a good job for you in general comes down to your own unique strengths, interests, and future career ambitions. It’s not for everyone, but for the right person, it can be a fulfilling and rewarding career path.

As the financial landscape continues to evolve, so too does the role of debt collectors.

Debt collection is a multifaceted career requiring talent in various areas of communication, negotiation, analysis, and law. It can be tough but still very rewarding and provides a way to develop yourself and support both creditors as well as debtors in achieving win-win solutions.

Are you ready to take your debt collection career to new heights? Then, become a member of Connection2Collections today and unlock a world of opportunities. Designed to keep you at the cutting edge of debt collection, our platform provides you with access to experienced professionals, real-life experiences, and insights, plus unique debt collector tools and techniques.

You have so much to gain, whether you are an individual or a company. You’ll be linking up with seasoned pros in the industry. You’ll gain from their first-hand knowledge, experiences, and winning collection strategies. Isn’t that wonderful? See you in the winner’s circle!