What is a Debt Collections Agency?

Suppose–on the simplest level–you have a customer who owes you money for services rendered and has not paid for the past three months. You have emailed, called, and perhaps even attempted the ‘bumping into them at the coffee shop’ approach. Nothing’s working. What, then, do you do? Better call a debt collection agency!

These agencies are professional in the act of locating debtors and persuading the debtors to clear the due debts. They have methods and strategies that are different from the normal accounts receivable collection procedure. This includes using skip-tracing, negotiating with the debtors, and, in some cases, even going to court.

And that’s why, today, I’ll be explaining exactly what debt collection agencies are. What are they? How do they work? And perhaps most crucial of all, what can one expect from them?

What is a Debt Collections Agency?

Debt collection agencies can be likened to the financial world’s cleanup crew. They step in to clean up your debt-induced financial woes by stepping in to recover your debts, especially after multiple failed attempts on your end.

The debts in question come in all kinds of forms. I’m not just talking about a backlog of unpaid bills for the products or services, although that is a big one. It could be outstanding loans you’ve given to other businesses, student loans, lease payments on equipment you’ve rented out, or even B2B credit card debts. In short, if it’s money another business owes you and they are difficult to get along with, this money can be recovered by a collection agency.

There’s more to hiring a debt collection agency than just recovering your money. By handing them over to these agencies, you free up your time and resources to face other tasks. After all, every hour you spend on the tedious, fruitless search for defaulters is an hour you’re not spending growing your business. So surely, it makes more financial sense to hand it over to the pros and focus on what you do best.

How Do Debt Collection Agencies Work?

Debt-collecting agencies aren’t just about strong-arming people into paying up. Rather, they understand that sometimes negotiation is the only way to arrive at a solution. That’s why learning how to improve your negotiation skills is important as a debt collector.

These agencies have some strategies and tricks up their sleeves that come in handy when doing their job. They have sophisticated skip-tracing facilities to locate defaulting clients on the run. They fully understand all the legalities of credit regulation and other legalities concerning debt collection. And let’s face it, getting a call from a collection agency or a collection agent showing up on your doorstep is enough to motivate a defaulter to pay the debt.

Here’s where it gets more interesting–some agencies work on commission; they are only paid if they are able to recover the money. This is ideal because you won’t be paying with money from your bank accounts. Other agencies may also decide to buy the debt from you outright at a lower price. You get a cut of the debt’s worth, and then it becomes their headache to recover the money. It’s less money, sure, but it’s guaranteed cash in your pocket.

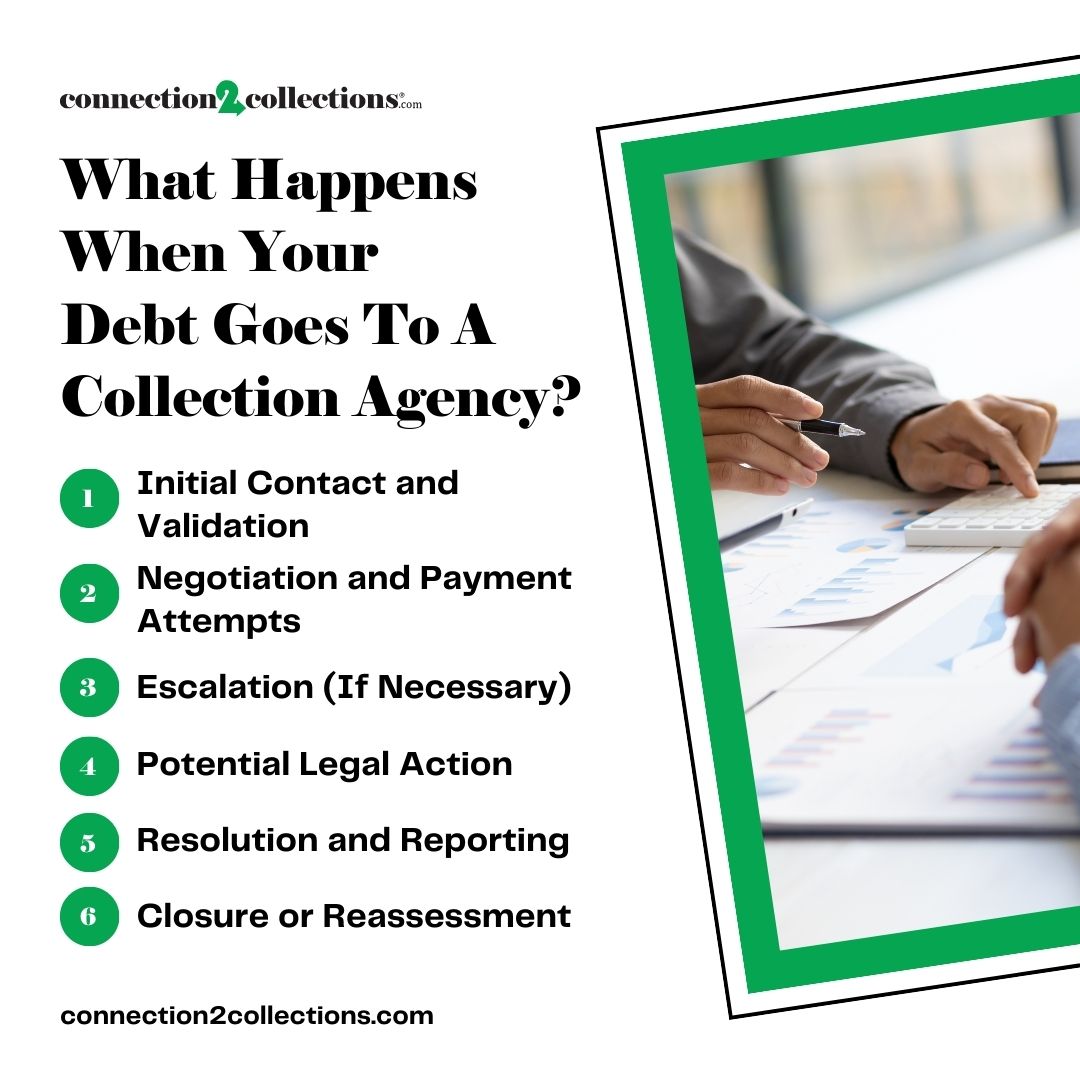

What Happens When Your Debt Goes To A Collection Agency?

Once a debt has been transferred to a collection agency, the following typically happens thereafter:

Step 1: Initial Contact and Validation

The agency will contact you through phone calls and/or emails. According to the law, they are required to mail you a notice within five days of first contact. This notice should indicate the debt, the creditor, and your rights. You’re expected to diligently go through the mail. You also have the right to demand that the creditor validate your debt, so if something seems off to you, speak up. You then have 30 days to dispute the debt

Step 2: Negotiation and Payment Attempts

The agency will demand payment in full, but there’s always room to come to some sort of agreement. They may offer a payment plan, incentives, or even be willing to accept less than the full amount. Collection agencies normally work on commission, meaning that they get a share of the recovered amount. So, expect the collection agents to be driven to find a solution.

Step 3: Escalation (If Necessary)

If things are not going the agency’s way, then they might decide to escalate things. For stubborn debts, the agency might choose to employ more aggressive tactics. This could mean more phone calls, letters with stern tones, or even the threat to take legal action. While they can’t ‘harass’ you it’s against the law they most certainly can be persistent.

Step 4: Potential Legal Action

This is the nuclear option in legal collections. It’s the last option for a reason. Suing the debtors may result in their wages getting docked or liens being placed on their properties. It’s also pretty costly and time-consuming for every involved party, be it the original creditor, the debt collector, or definitely the defaulter.

Step 5: Resolution and Reporting

Here’s where the money exchanges hands. If the agency is able to recover the debt, it receives its commission (which ranges between 25% and 50%), and then the rest is paid to the original creditor. They will also adjust your credit reports to reflect the debt as paid or settled.

Step 6: Closure or Reassessment

If the debt is paid, great you won’t have to worry about the statute of limitations which is often within 3-20 years depending on the state. Case closed. Otherwise, the creditors may be forced to either cut their losses or try again with a different agency.

What Can a Collection Agency Do To Collect Debt?

The Fair Debt Collection Practices Act (FDCPA) lays out what they can and can’t do. So, let’s break down exactly what the laws permit these agencies in their attempt to collect debt:

Contact You Directly

Oftentimes, this is the first thing that they do, and it’s completely legal. Debt collection agencies can call debtors, write them, send emails, or even send them text messages. They may be pushy, but there are rules governing how pushy one can be. For instance, they can’t call before 8 a.m. or after 9 p.m. without your permission. Also, they’re not permitted to call you at your workplace if you’ve already informed them that your employer frowns against such calls.

Negotiate Payment Terms

Some flexibility can be good in the debt collection business, indeed. Collection agencies might suggest a new payment plan or a lower cash settlement. Another option is the ‘pay for delete’ option, in which the collection will be deleted from the credit report. This can be a useful tool for both parties to resolve the debt without resorting to more drastic measures.

Report to Credit Bureaus

Collection agencies are permitted to report the debt to major credit bureaus like the consumer financial protection bureau. Doing so may negatively affect the debtor’s credit score. Such a stain can stay on the credit report for as long as seven years. This will, in turn, impact your chances of securing credit in the future or receiving favorable terms with suppliers.

Pursue Legal Action

As stated earlier, a collection agency can take the debtor to court in a bid to recover the money. This is usually done when all other approaches have proven abortive. Meanwhile, the court order often favors the collectors.

Sell or Transfer the Debt

A collection agency can pass on or sell a debt to another collection agency. Every time this occurs, the debtor is to be notified that a change has been made. Either way, the new agency must work under the same FDCPA guidelines as the former.

Use Skip-Tracing Techniques

Skip tracing is used by agencies if you have changed your contact information or the physical location of your residence. This involves searching public records, databases, and even social media to locate debtors. It’s perfectly legal and a common practice in the industry.

Growth comes faster when you have a supportive community to lean on.

The finance world is ever-changing, and acquiring knowledge is vital if you want to excel in business nowadays. So, what should your next step be? Well, you could try to go solo, gathering information from here and learning through trial and error. Alternatively, you could fast-track your business growth by joining Connection2Collections. After all, time is money., especially in this fast-paced world of business.

When you register at Connection2Collections as an individual or company, you’re not just creating a profile but also entering a world full of information and possibilities. You’ll learn from the experiences of seasoned professionals who’ve been in your shoes. You’ll also find out the latest trends regarding the collection of debts and financial management. There’s also the opportunity to get acquainted with other like-minded people in the industry. See you there!