What Every Collector Should Know About Brand Awareness

One of our favorite sites for good business definitions, Investopedia.com, defines “Brand Awareness” as; “The likelihood that consumers recognize the existence and availability of a company’s product or service. Creating brand awareness is one of the key steps in promoting a product.” We want to talk to you about a different kind of brand awareness, because in the debt collection arena, we are a proxy of our clients, and collectors need to know these brands so that they can represent the ideals and images that their clients’ customers have come to expect.

Brand Awareness for Debt Collectors

It’s important to recognize a crucial aspect in successfully representing a client in a collection matter; when the; [customer/card-member/guest/account-holder/consumer ] (debtor) gets a call from a debt collector for a debt they owe, the last thing that debtor thinks about is the company the debt collector works for, they automatically associate the experience with the collector to the company that they owe a debt to. When we call to collect on an ABC Credit Card Account, the debtor is receiving a call from ABC Bank, NOT from XYZ Collection Agency.

Some of you may think that it doesn’t matter, and some managers may have a hard time getting this across to their collectors. The wrong attitude from collectors is; “I need to verify employment and discuss a SIF, I can’t always remember ABC Bank’s motto.”, but the truth is, these days, the best collectors not only know their paper, but they become a part of the brand they are collecting for.

The average American buys 12 cars in their lifetime, don’t you think the good people over at Ford Motors want all twelve of those cars to be a Ford? Think about it, as a business you sell a product and you want your customers to feel that they are a part of that product, that they have a relationship with your brand. If you go to a Ford dealership and get treated like royalty, and then you lose your job and can’t make your car payments and a collector calls you and treats you like dirt, well you’re not going to be too happy with the relationship you have with Ford (BECAUSE of the collector). Chances are, Chevrolet and GMC will be their next car choice.

Customer Experience

The thing is, that customer should have the exact same customer experience with every different level of the relationship. If Ford Motor Credit lends a customer money, and then you as a collector call to collect on the deficiency, how you treat that customer will have a serious effect on their willingness to go back to Ford for their next car. The more awareness a collector has for the brands he represents on a collection call, the higher the likelihood that the customer will be willing to return as a customer when they get their finances turned back around.

So, collectors may be thinking; “What benefit do I have if a customer goes back and buys another Ford if I’m just trying to collect the debt?” Well, let’s review it. First off, the industry has changed, being a tough collector who doesn’t take no for an answer won’t fly. It’s practically an industry standard now that all collection calls are recorded and then submitted to the client for review. A collector can make a phone call and be 100% compliant without having brand awareness, but if a client recognizes that a collector is going out of there way to not only adhere to the rules and regulations, but also makes sure that their customer receives the same or similar treatment as if they were talking to a customer service representative, that can go a long way.

So, collectors may be thinking; “What benefit do I have if a customer goes back and buys another Ford if I’m just trying to collect the debt?” Well, let’s review it. First off, the industry has changed, being a tough collector who doesn’t take no for an answer won’t fly. It’s practically an industry standard now that all collection calls are recorded and then submitted to the client for review. A collector can make a phone call and be 100% compliant without having brand awareness, but if a client recognizes that a collector is going out of there way to not only adhere to the rules and regulations, but also makes sure that their customer receives the same or similar treatment as if they were talking to a customer service representative, that can go a long way.

Don’t believe us?

Ask your boss what happens when a client tells them that they really like Joe or Jill Collector’s calls. Our guess is that they start to flow more accounts to that collector, because the number one rule in this industry is “Keep.The.Clients.Happy.” Not only that, but you’re doing a better job when you represent the brand according to the company’s goals. Whether you like it or not, you’re developing a relationship with every debtor you contact, and your agency or law firm more than likely represents itself as a business that upholds the integrity of their clients. So live up to your company’s brand and do what’s right for your own personal brand as well, be the best collector you say you are. The more you work to represent your company’s clients, the better off you will be as a collector down the road.

So how do you find out more about the paper your working and the brand you represent?

If the information hasn’t been spoon fed to you, well your manager may need to re-evaluate their strategy because brand awareness is extremely important in collections today. Your first option is to ask for it, ask your boss or your client services people for any documentation the clients may have sent over regarding brand awareness. If they don’t have it, you can always Google the client’s website and go to their ‘About’ page. They will usually have their “Vision” and “Values” there. Find out exactly what they want their customers to think and feel when they buy their products or services. Last, but not least, you can learn about the brand just like their customers do, through the media and advertisements.

Pay attention to the ads you see on TV and in magazines, for example;

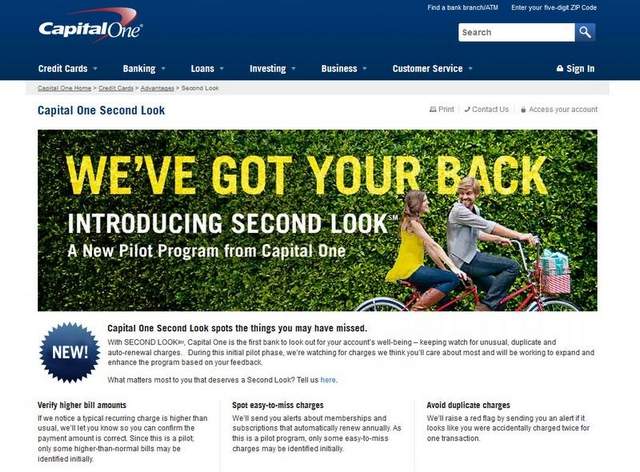

So here we have a Burger King ad, a Discover Financial ad, and a CapitalOne Credit Cards ad. Each one represents a certain aspect of their brand and delivers a message to their current and prospect customers.

So here we have a Burger King ad, a Discover Financial ad, and a CapitalOne Credit Cards ad. Each one represents a certain aspect of their brand and delivers a message to their current and prospect customers.

Burger King

Burger King has always made sure the customer knows that he/she can “Have it YOUR way”. What this means is that every time you go to Burger King, you can make changes to your burger, swap things in and out, and customize it unlike other places that don’t let you alter the menu. As seen in this ad, now you can get burgers in your burger. LOL

Discover Financial

Discover Financial has recently began their “it” campaign. They want their customers to know that the “it” card will provide customer service with “heart”. You may have seen their commercials that say “We treat you, like you treat you.” This is a great campaign, and an extremely valuable form of service that they deliver to their customers. Discover promises that when dealing with their company, you will be treated with great service, and with empathy. The key is that the people (collectors) who represent them and talk to their customers, have to uphold these ideals.

CapitalOne

Finally the CapitalOne “We Have Your Back” campaign. This is a feature where the bank will look out for their customers for double charges, overdrafts, and any suspicious activity. The message here is that they want their customers to feel that they are safe with CapitalOne. If a collector makes the customer feel taken advantage of or doesn’t show empathy for a difficult time or mistake, it demeans the entire message.

Debt collectors aren’t the only ones under fire, the banks are always being scrutinized for their policies, and they have to earn the trust from their customers. It’s up to us to uphold that trust. Any collection outfit in today’s collection environment will be better off if they are training their collectors and their staff to know the brands that they represent in collection matters. The industry needs responsible collectors, but the greatest asset to any collection outfit is going to be a collector who goes the extra mile to give the clients and their customers the service they expect.

Always do your best to act responsibly and show empathy to the clients’ customers. The more aware you are of their brand, the better job you can do in maintaining the integrity of the customer’s experience with their products and services.

And please, oh please, don’t be a Peggy!

2 Comments

Leave a Reply

You must be logged in to post a comment.

Lisa Waller - October 9, 2014, 8:11 am

I really learned a lot from this . Great

Connection2Collections - October 9, 2014, 8:43 am

Thank you for the feedback! We are glad you enjoyed it!