How Many Times Can a Debt Collector Call?

Here’s the thing about debt collection: it’s a legitimate business practice. Collectors are supposed to reach out through various channels: mail, phone calls, and even fax. And sure, they’re just doing their job. I mean, everyone needs to make a living, right? But there’s a fine line between persistent and pestiferous, and some collectors treat that line like it’s a suggestion rather than a boundary.

One minute you’re getting the occasional reminder call, and the next thing you know, your phone is ringing more often than a coffee shop’s tip jar. They consistently disrupt your daily routine and intrude on other important things. This could mean the inevitable ring during your morning coffee, an important work call, or even while spending quality time with your family. They somehow know exactly when to buzz in and frustrate you.

Well, there’s good news! You don’t have to suffer through endless calls that make you feel like you’re being haunted by a particularly persistent telemarketing ghost. There are actually laws and regulations that control how and when debt collectors can contact you. They are meant to protect you from abusive debt collection practices by CACI debt collectors.

So today, I’m going to talk about how many times debt collectors are allowed to call you.

How Many Times Can a Debt Collector Call?

The slightly frustrating but honest truth is that there’s no specific legal limit on how many times a debt collector can call you. However, while there isn’t a magic number like “three calls per day” or “ten calls per week,” there’s actually some good news hiding in the fine print of the Fair Debt Collection Practices Act (FDCPA). FDCPA is a federal law that prohibits debt collectors from engaging in practices that “annoy, abuse, or harass” you.

But what counts as harassment? Well, according to the Federal Trade Commission (FTC), some red flags include:

- Calling multiple times a day

- Calling back immediately after you hang up

- Calling at odd hours (before 8 AM or after 9 PM)

- Calling you at work after you’ve told them not to

- Making threats or using profane language

- Leaving voice messages that don’t identify them as debt collectors

And get this—the rules don’t just apply to phone calls anymore. The same principles cover text messages, emails, and social media contacts. Because apparently, some collectors thought, “if we can’t call them a million times, we’ll just slide into their DMs instead”.

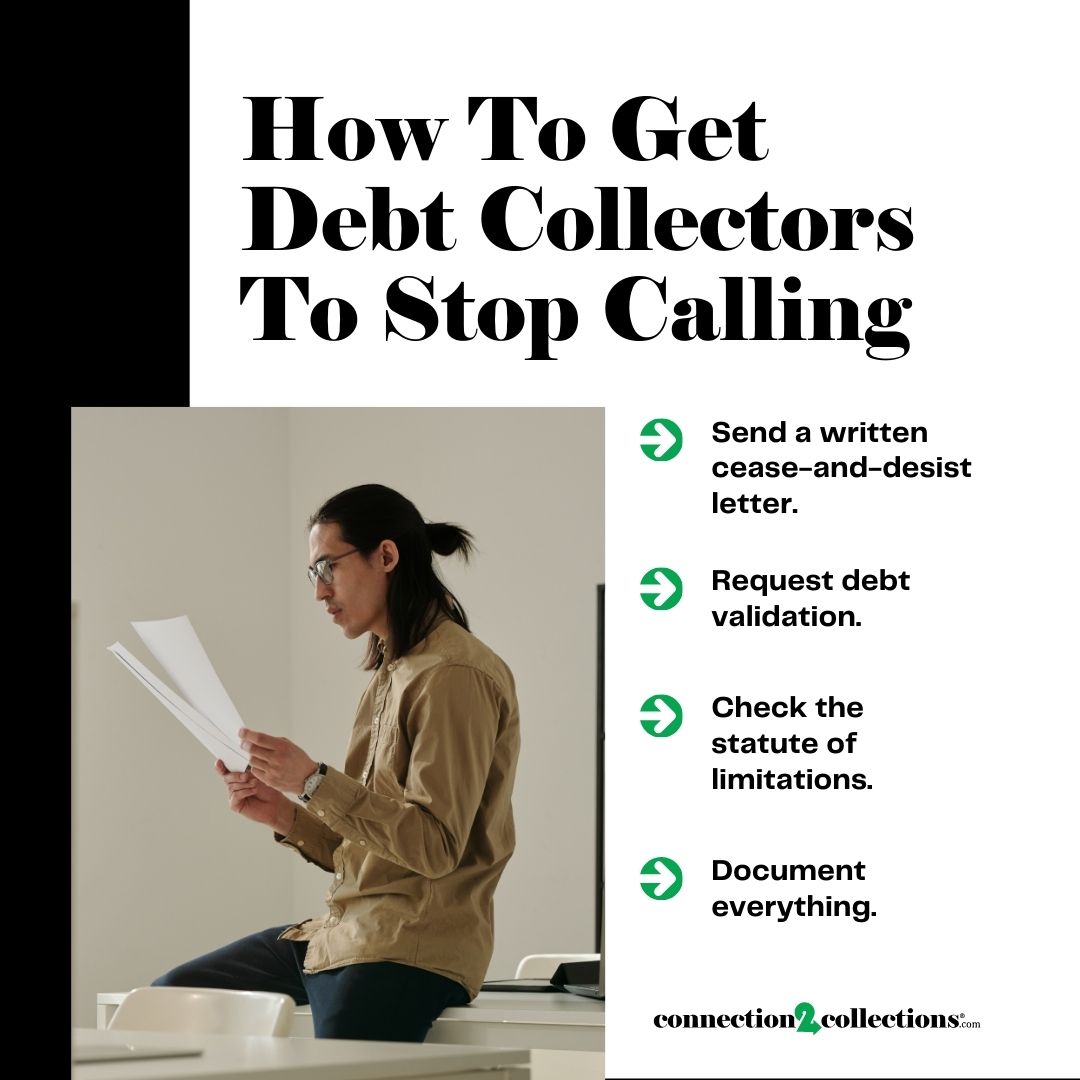

How To Get Debt Collectors To Stop Calling

There are several legitimate ways to regain your peace and quiet. Let’s explore your options for turning those constant rings into blessed silence.

Send a written cease-and-desist letter.

A cease-and-desist letter is like having a restraining order for your phone number. Once received, collectors must stop contacting you except to notify you about specific actions, like filing a lawsuit. Doing anything else means they’ve violated the FDCPA stipulations, which have serious consequences. You can formalize this letter by sending it via certified mail with a return receipt requested. Include your name, address, account number, and a clear statement requesting they stop all communication.

Request debt validation.

Before you do anything else, flex your legal muscles and demand proof that this debt is actually yours and valid. You have the right to request debt validation within a 30-day period of first contact. This forces the collector to hit pause on their calling campaign while they gather evidence that you owe this debt. They’ll need to provide details about the original creditor, the amount owed, and proof that they have the right to collect debt.

Check out this post for more on how to see your total collections debt.

Check the statute of limitations.

Time might actually be on your side here. Every state has a statute of limitations on debt collection. After a certain period, the debt becomes “time-barred,” meaning collectors can’t successfully sue you for payment. This doesn’t erase the debt, but it gives you some serious leverage. So research your state’s laws or consult with a consumer protection attorney to understand your timeline.

Document everything.

Keep a detailed log of every call. Note the date, time, caller’s name, company, and what was discussed. Save voicemails, text messages, and emails. You can also take screenshots of caller IDs. Doing all these gives you a paper trail if you need to file a complaint or take legal action. Think of it as building your case file—if collectors are breaking the rules, you’ll have the evidence to prove it. Plus, sometimes just letting them know you’re keeping records can make them straighten up and fly right.

These steps aren’t about avoiding your responsibilities—they’re about ensuring debt collectors play by the rules while you figure out your next move.

After all, while you might owe money, you definitely don’t owe anyone your sanity or peace of mind. By understanding your rights, knowing the legal limits on collection calls, and having a solid action plan, you can take control of the situation and protect your peace of mind.

Ready to become an expert in everything debt collection? Then join Connection2Collections and transform the way you handle collection scenarios. Whether you’re a collection professional, agency owner, or looking to sharpen your collection strategies, our community provides the perfect platform to grow.

You’ll gain exclusive access to expert insights, stay updated with compliance requirements, and connect with seasoned professionals who understand the intricacies of the collection industry. Join our thriving community today and take your collection expertise to the next level. See you there!