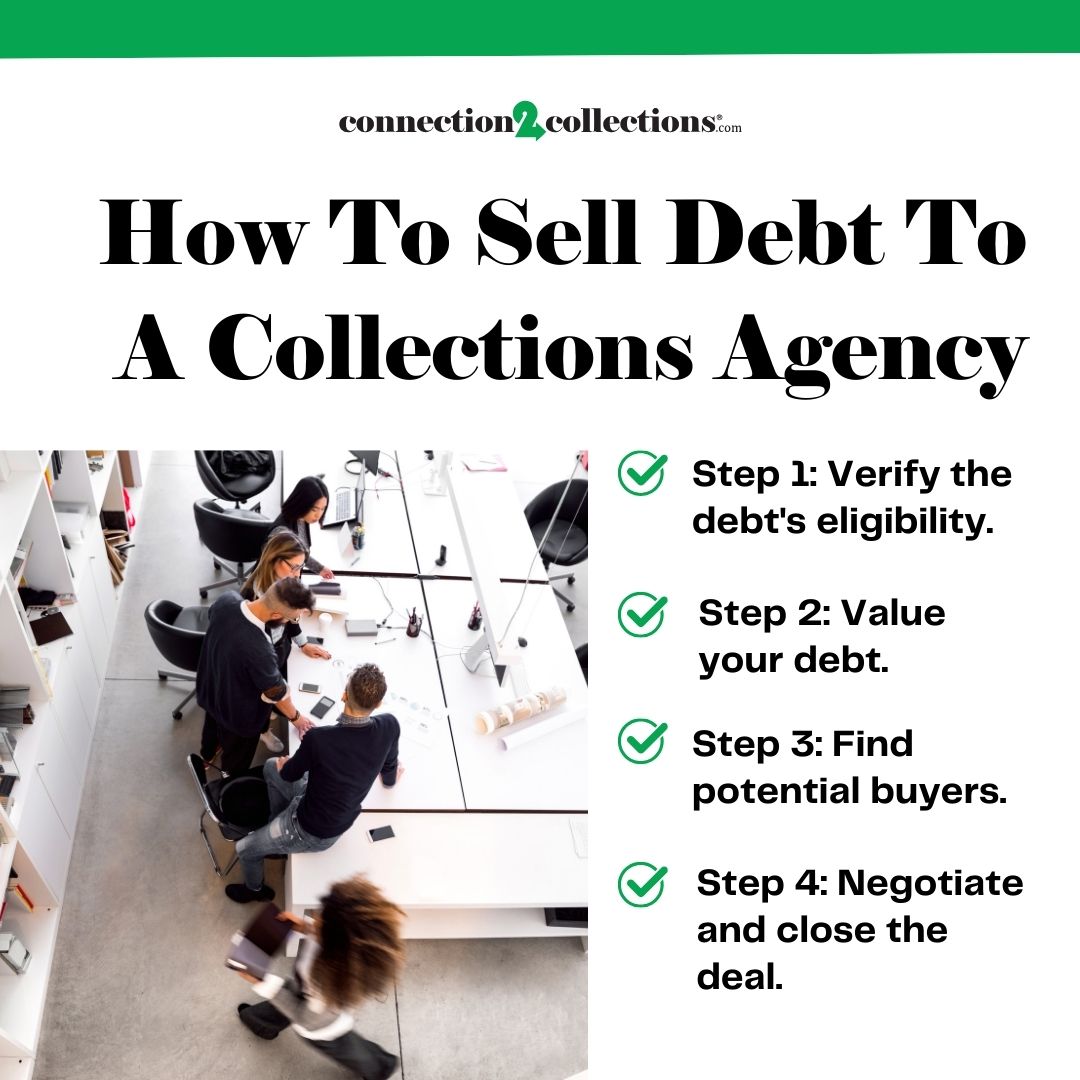

How To Sell Debt To A Collections Agency

Picture this: you came through for some individuals, companies, or other entities in need by lending them your hard-earned money. They gave you their word, or even put it in writing, to repay in the not-too-distant future. But alas, when the time came for them to repay their debt, they failed. Humans and their fickle nature, right?

You’ve tried different approaches to recover your money, maybe you even took legal actions, but still failed to collect the debt. It’s starting to show in your business with a pile of receivables that’s starting to look more like a mountain. And with your hope dwindling each day, you’re already considering writing off the unpaid debt as charged-off. But, what if there’s still a way to recoup your money?

Remember the saying, “If life gives you a lemon, make a lemonade?” That’s where selling debt comes in. You see, just because your defaulters won’t honor their agreement doesn’t mean you or your business have to bear the brunt completely. Rather, you can sell those debts to collection agencies or some other bodies. It’s not the full amount, sure, but hey, something is better than nothing, right?

The recovered amount will not just help you clear your books but also boost your bottom line. That’s why, today, I’ll be walking you through the ins and outs of selling debt to collection agencies!

How To Sell Debt To A Collections Agency

Let’s face it: incurring debt in the business world is as common as raindrops in the spring. Every entrepreneur has been there at one point or another. It’s almost like a rite of passage. However, if you are still owed long after the pre-agreed repayment period and you’ve exhausted all options to collect the debt, what else can you do?

Well, more and more business owners and lenders are flipping the script these days. Instead of letting those unpaid bills gather dust, they sell them and recover a reasonable percentage. But, it’s not that simple because there is a legal side to it. Yes, a legal side you shouldn’t overlook.

Why should you care? Well, imagine that you are in the process of selling off some of your debts, thinking of yourself as a smart businessman. Then, all of a sudden, you find yourself deep in legal trouble. If that’s not an anti-climax after all you must have experienced, I don’t know what is.

Shortly, I’ll be explaining EXACTLY how to sell your debt to a collection agency in simple terms. You don’t have to be a lawyer to understand it. And by the end of it, you’ll know how it all works and, most importantly, how to avoid getting into legal trouble!

Can A Debt Be Legally Sold?

Absolutely. It’s completely legal and, therefore, has rules and regulations guiding it. The government of the United States has set up a whole system to ensure things are above board. This is where the Fair Debt Collection Practices Act (FDCPA) and the Federal Trade Commission (FTC) step in.

The FDCPA is like the bible for debt collectors and debt buyers. The FTC, on the other hand, is somewhat like the umpire or referee in this debt-selling game. Their job is to ensure everyone plays fair. They have standard procedures that cover everything from how debts should be documented all the way to credit reports, and what information needs to be passed along when a debt is sold.

Also worth noting is that different types of debt have different rules. The regulations that guide credit card debts are distinct from those of mortgage debt, consumer debt, or even medical bills. Plus, there’s the state law factor. Debt sales are pretty much allowed and straightforward in some states. Meanwhile, some other states have some additional regulations that can be quite strict.

All in all, selling a debt legally can be quite a complex process that requires you to have all your ducks in a row. That means you must familiarize yourself with what the rules say regarding proper documentation, debt ownership, paper trail, and others. There are even rules about who can buy these debts. In most cases, debt buyers are required to be licensed and registered, depending on the state.

Who Buys Debt?

So which bodies or agencies are eligible to buy debt? Well, these include the following:

- Debt-collection agencies

- Debt-buying companies

- Banks and financial institutions

- Private equity firms

- Law Firms

- Credit Unions

- Government Agencies

- International Investors

Once they successfully purchase the debt from the original creditor, they can then proceed to use either non-legal or legal collection means to recover the debt from the defaulter. However, collection companies are required under the law to give debtors a 30-day notice to dispute a debt. This is often done by sending him/her a dispute letter by certified mail. After which they’ll go all out to recover the debt, either by garnishing their wages, providing incentives, or creating a new payment plan.

How To Sell A Debt To A Collections Agency

Below are practical, actionable steps to take when selling your debt to a collection agency:

Step 1: Verify the debt’s eligibility.

The first thing to do is confirm that your debt is actually sellable. That’s because not all debts are the same, have the same weight, or are created equally in the eyes of debt buyers.

Before you jump the gun in search of a collection agency to sell to, be sure beyond doubt that the debt has not passed its statute of limitations. This is usually not more than 10 years, but it may vary from one state to another.

Also, ensure that you have all the documents you need in one place. This includes original contracts, payment histories, and any other relevant documents.

Finally, confirm that you actually own the debt and that you indeed have the right to sell. It may sound obvious, but you’d be surprised how often something as little as this trips people up.

Step 2: Value your debt.

It’s time to put a price tag on that debt. But before you pull a number from your hat, let’s talk strategy.

First, find out the current market prices for such debts. Then, take certain factors like the age of the debt, the amount owed, and the likelihood of collection into consideration when deciding. You see, a fresh debt is like a new car it’ll fetch a higher price than one that’s been sitting around for years.

And remember–you don’t need to make this decision all on your own. Seek expert opinions, which you’ll get in abundance at Connection2Collections.

Step 3: Find potential buyers.

Now is the time to find suitable buyers for your debt. Start by doing deep research on reputable debt buyers and collection agencies. But don’t just do a general search. Focus on agencies that specialize in your type of debt.

You can fast-track your search by checking out industry associations and networks. They often have directories of legitimate buyers. One more thing–don’t be shy about reaching out to multiple potential buyers. The more, the merrier!

Step 4: Negotiate and close the deal.

Having an agreement on the terms of the sale and then proceeding to close the deal is the final step in the debt-selling process. This is where you put on your negotiating hat. But, be prepared to haggle.

Debt buyers have certain expectations, and they are always looking for a bargain. So, don’t be taken aback if they offer a low price. Also, get everything in writing. And I mean everything. The price, the terms, what happens after the sale, and any other relevant information. If it’s not written down, it didn’t happen. I’ll also advise you to use a neutral payment service like Escrow for the transaction. This ensures no one suddenly backs out at the end for unjustified reasons.

Both parties are then expected to sign on the dotted line. Without doing this, the deal is as open as the sky; it’s not closed. Once signed by the negotiating parties and verified legally, the deal is closed!

The wheels of the finance world are always in motion what’s hot today might be old news tomorrow.

Therefore, you must be on high alert at all times. That’s the way of successful business owners, and it’s a path you should follow too. You must be well-informed and updated on the newest trends so as not to be left behind.

Sure, you could go it alone, piecing together information from various corners of the internet. But why reinvent the wheel when you can be enjoying a smooth ride with Connection2Collections? Connection2Collections is essentially your ticket to the big league in the debt collection and selling business!

When you sign up with Connection2Collections as an individual or company, you’re not just creating another online profile. Rather, you’ll get to rub elbows with the industry’s heavyweights and stay on top of the latest trends. You may even find some like-minded people among these debt-collection enthusiasts who will help you actualize your career dream.

So, what are you still waiting for? Join Connection2Collections today and turn those debt lemons into sweet, sweet lemonade. See you there!