How To Write a Debt Collection Letter That Wins

We all know that cash flow is the lifeblood of any business. Without proper cash flow, how will you pay your bills or compensate your employees? Even the government is always awaiting their piece of the cake (tax). Fail to fulfill any of these obligations, and your business doors may become permanently shut. So, what can you do when those payments start lagging? How can you ensure a couple of unpaid debts don’t put you out of business?

The very first step the law advises original debtors to take in situations like this is to write a debt collection letter. Yes, that’s right! It’s not to pick up the phone and demand for your money. Neither is it to pay the debtor a visit, become a stalker, or any other unlawful practices.

But why write a letter? After all, we’re in the digital age, which is so much faster. Well, my friend, nothing beats having a paper trail in the legal collections world. A well-written debt collection letter becomes especially important if things escalate to legal actions. It’ll serve as hard evidence and boost your chances of recovering your money.

Surprisingly, not many are aware of this very important step. That’s why today I’m sharing a step-by-step guide on how to write an effective collection letter to people who owe you money. Let’s get into it!

How To Write a Debt Collection Letter that Wins

Remember the saying, “Whatever’s worth doing at all is worth doing well?” Writing a debt collection letter is one of the steps provided under the law to recover debt owed. In fact, it’s the very first step. So, you should maximize this tool by ensuring you write an effective debt collection letter.

Shortly, I’ll be shedding more light on everything you need to know about writing a debt collection letter. We’ll explore what makes it tick and how to leverage it. But most importantly, we’ll discuss the key elements you absolutely need to include to make it effective.

Once you understand what goes into writing a great debt collection letter, you’ll be able to tailor your approach to fit any situation!

What is a Dunning Letter?

The word “dunning” actually comes from an old English verb “dun,” meaning to make persistent demands for payment. Pretty fitting, right?

Writing a dunning or debt collection letter is like the formal, business-y way of saying, “Hey, remember that money you owe us? Yeah, we haven’t forgotten about it either.” It’s a way of sending a polite but firm reminder about an outstanding debt to a client or customer. You’ll then urge them to pay up within a specified period.

You’ve provided a service/product. So, it’s about time they held up their end of the bargain. But, what elements are needed to convey this message in your letter?

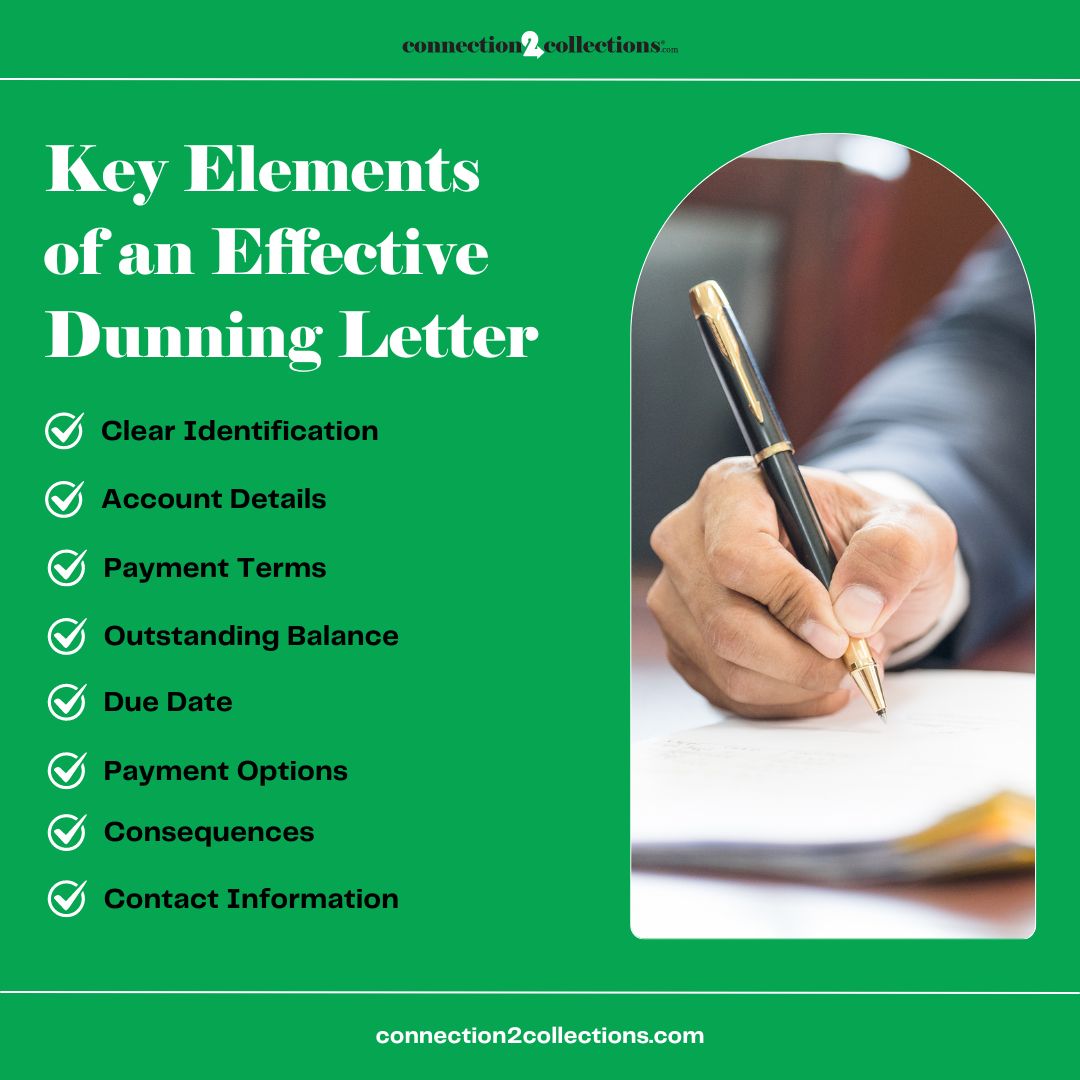

- Clear Identification: Start by clearly stating who you are and which company you represent.

- Account Details: Include all relevant account information, such as invoice numbers, dates, and amounts due. This will help the client know exactly what you’re talking about.

- Payment Terms: Remind them of the agreed-upon payment process or terms. This isn’t about pointing fingers; it’s about establishing facts.

- Outstanding Balance: Clearly state the amount that’s overdue. No need to beat around the bush here.

- Due Date: Set a clear, reasonable deadline for when you expect payment.

- Payment Options: Make it easy for them to pay by outlining the available payment methods.

- Consequences: Gently (but firmly) explain what will happen if the payment isn’t made by the due date. This could be late fees, interest charges, further collection actions, or even initiate legal proceedings.

- Contact Information: Provide clear contact details in case they have questions or want to discuss payment arrangements.

Remember, the tone of your letter matters just as much as the content. As much as you want to be firm and clear, be careful not to sound aggressive or threatening.

And here’s a pro tip: consider sending a series of dunning letters with escalating urgency. That means you can structure your first letter to serve as a gentle reminder only. However, if the debtor is still not forthcoming, subsequent letters can become gradually firmer.

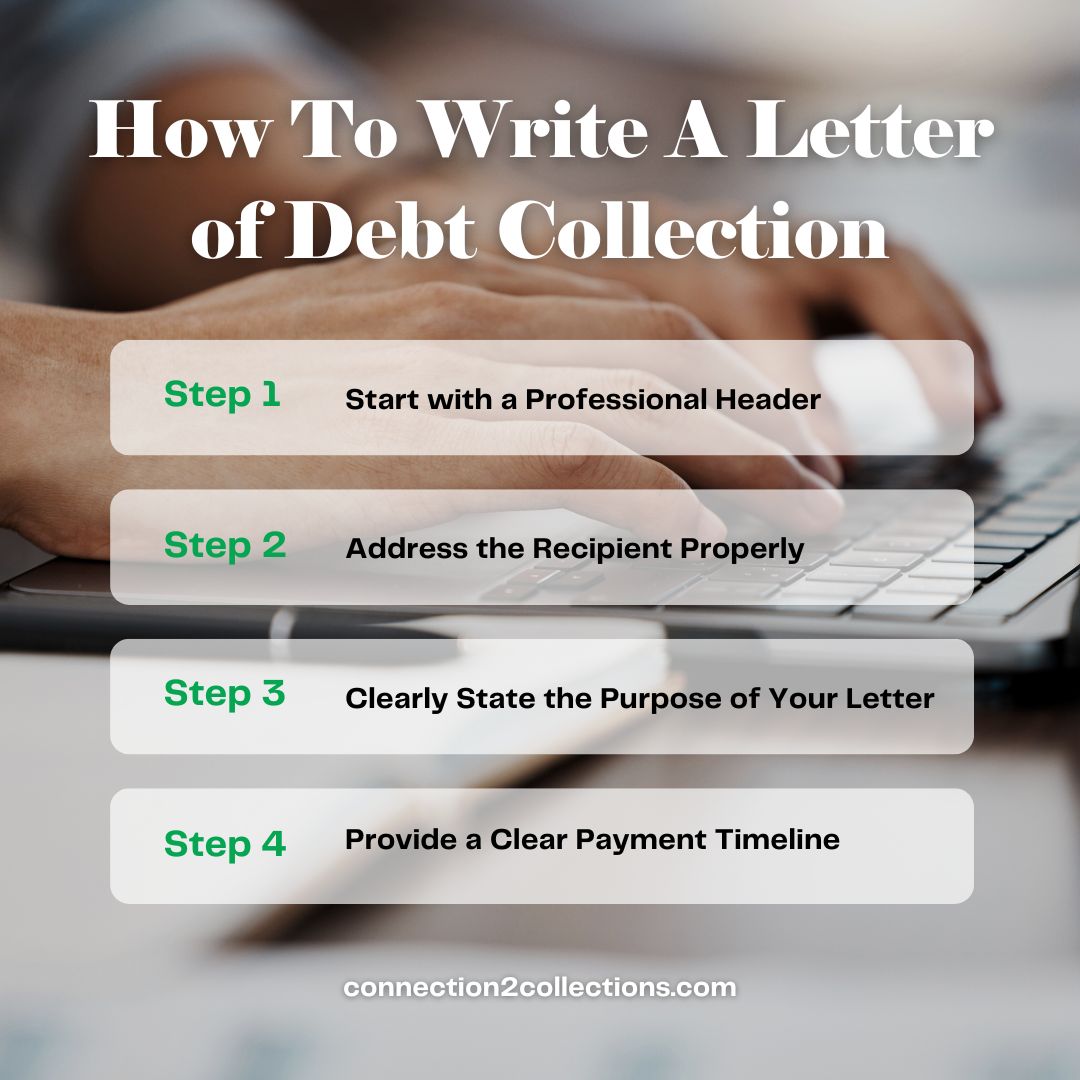

How to Write a Letter of Debt Collection

You may decide to undertake this task on your own. Or better still, you can hire a collection agency or CACI debt collectors. Either way, below is the step-by-step process for writing a letter of debt collection:

Step 1: Start with a Professional Header

First impressions matter, even in debt collection. Your letter should look professional from the get-go.

Starting your letter with a proper header sets the tone for the entire communication. It immediately tells the recipient that this is an official business matter, not just a casual reminder. Here’s what you need to include:

- Your company/ debt collection agency’s name and logo

- Your company’s address

- The date of the letter

- The recipient’s name and mailing address

This information not only makes your letter look professional but also ensures it reaches the right person. Plus, it provides a clear record of when the letter was sent, which can be crucial if further action is needed down the line.

Step 2: Address the Recipient Properly

Addressing your letter to the right person is crucial. “To Whom It May Concern” might be easy, but it’s impersonal and can easily be ignored. Instead, try to find out who’s responsible for accounts payable in the company you’re contacting. Here’s how to nail this step:

- Use the person’s full name if you have it.

- Include their job title if known.

- If you’re unsure, call the company and ask who handles accounts payable.

By addressing a specific person, you’re more likely to get your letter into the right hands quickly. It also shows that you’ve put effort into your communication, which can encourage a faster response.

Step 3: Clearly State the Purpose of Your Letter

The opening paragraph of your letter should clearly state why you’re writing. Remember, clarity while informing debtors about their outstanding balance is key here. Don’t beat around the bush; get straight to the point. You want the recipient to understand immediately what this is about. Here’s what to include:

- Mention that this is regarding an overdue payment.

- Reference the specific unpaid invoice number(s) and date(s).

- State the total amount due.

For example, you might write: “I am writing regarding the outstanding payment of $X,XXX for invoice #12345, dated January 1, 2024.” This direct approach leaves no room for misunderstanding. It also shows that you have all the relevant information at hand, which can prompt the recipient to take your request seriously.

Step 4: Provide a Clear Payment Timeline

Now that you’ve stated the purpose, it’s time to let the recipient know when you expect payment. Set expectations and deadlines to encourage prompt action. This step is crucial because it depicts the urgency of the situation and gives the debtor a clear target. Here’s how to do it effectively:

- Specify the exact date by which you expect payment.

- Remind them of the original payment terms (e.g., “As per our agreement, payment was due within 30 days of invoice date”).

- If applicable, mention any late fees or interest that may have accrued.

For instance: “Please ensure that full payment is made by [specific date]. As per our agreement, a late fee of 1.5% per month will be applied to any balance remaining after this date.”

Setting a clear time frame shows that you’re serious about collecting the debt and gives the recipient a concrete deadline to work towards. It’s a balance of being firm while still maintaining a professional tone.

Debt Collection Letter Template

Below is a template that incorporates all the elements we’ve discussed. This template will help you convey your message in a clear and professional manner. It’s also adaptable, so feel free to customize it to suit your specific needs and company needs.

Mastering the art of writing effective debt collection letters is a crucial skill in today’s business world.

It can be tempting to pour your annoyance and disappointment into your letter. Yes, you’re well within your rights to be angry. But doing this can make matters worse. Instead, try to maintain professionalism while firmly requesting what’s owed to your business.

By the way, are you interested in learning more about writing debt collection letters and many other elements pertaining to successful debt recovery? If so, I urge you to join Connection2Collections. This is a platform that helps you stay on top of the constantly evolving world of debt collection.

There’s so much to gain by joining either as an individual or company. I’m talking about connecting with seasoned pros in the industry. You get to learn from their real-world experiences. But that’s not all–these professional debt collectors will also help uncover secret debt collection processes and innovative collection strategies that will give your career a boost. Amazing, right? See you in the winner’s circle!