The CLOSEOUT Myth

The CLOSEOUT Myth

“I let all my bills go into collections because I prefer to pay them on the last day of the month.” ~ said NO ONE, EVER!

Here’s the deal, in the collections industry there is one day that is always known as the best day in collections for almost every collector in the business; the last day of the month. This isn’t something we’re going to back up with years of statistical analysis or surveys, let’s just say this is a fact that we can all agree on. That in collections, closeout (the last day of the month) is always the best.

There’s a company in California that tested this specific issue, and with a purpose, not just because it’s fun to mess around with industry logic. The issue was that client closeouts kept falling two to three days before the end of the month. So you would have a team of collectors who were at 94% to goal for Client A, and it was only the 23rd of the month. That’s a guaranteed goal if you give these collectors a full closeout, shoot you can almost project 120% with a good closeout!

Unfortunately, this client would say the month closes on the 28th, sorry guys, no closeout. Of course the team would come in at 98% to goal by getting as much in the door before the 28th, but good ol’ closeout comes around and they CRUSH the goal (if the month hadn’t already ended). So the manager there wanted to test this ‘Closeout Myth’ and decided to change the closeout dates for the collectors.

Here’s how it worked:

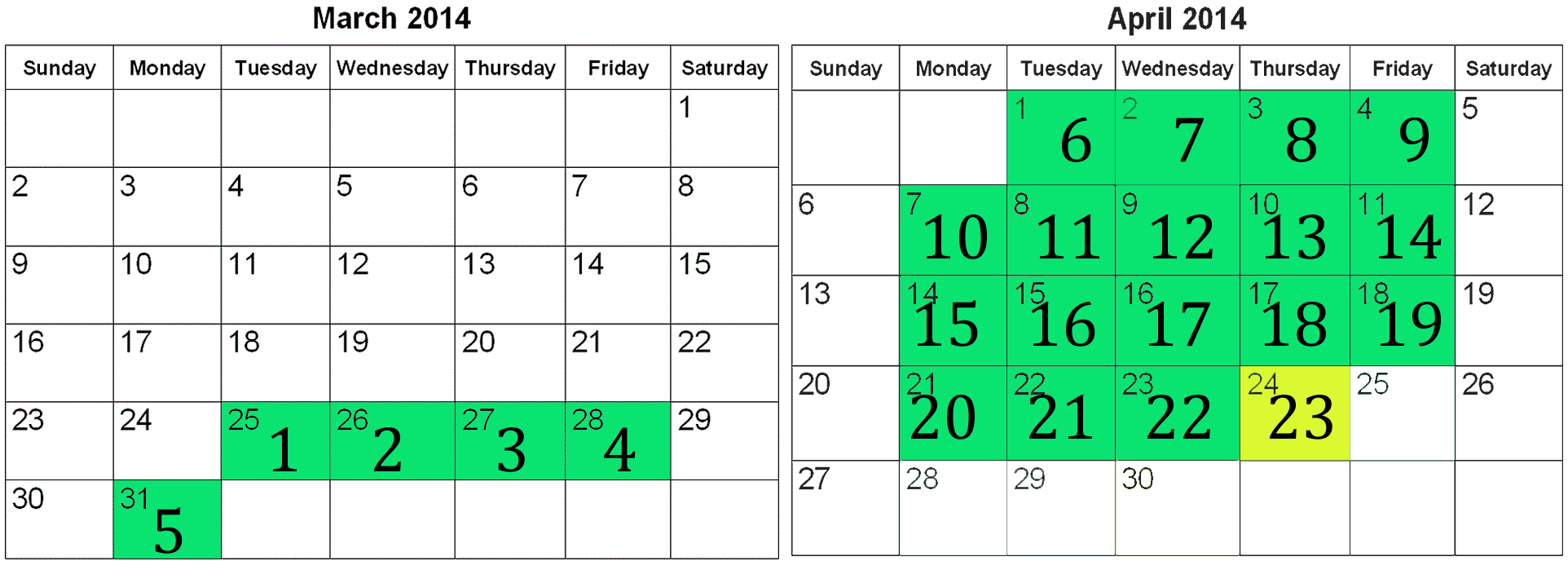

We’ll use April as our example month, because everyone in collections loves April. The collector month was changed to start on the 25th of a month, and end (or closeout) on the 24th of the following month. So April would be from March 25th thru April 24th. Well, as you can imagine, there was pushback. But let’s take a closer look…

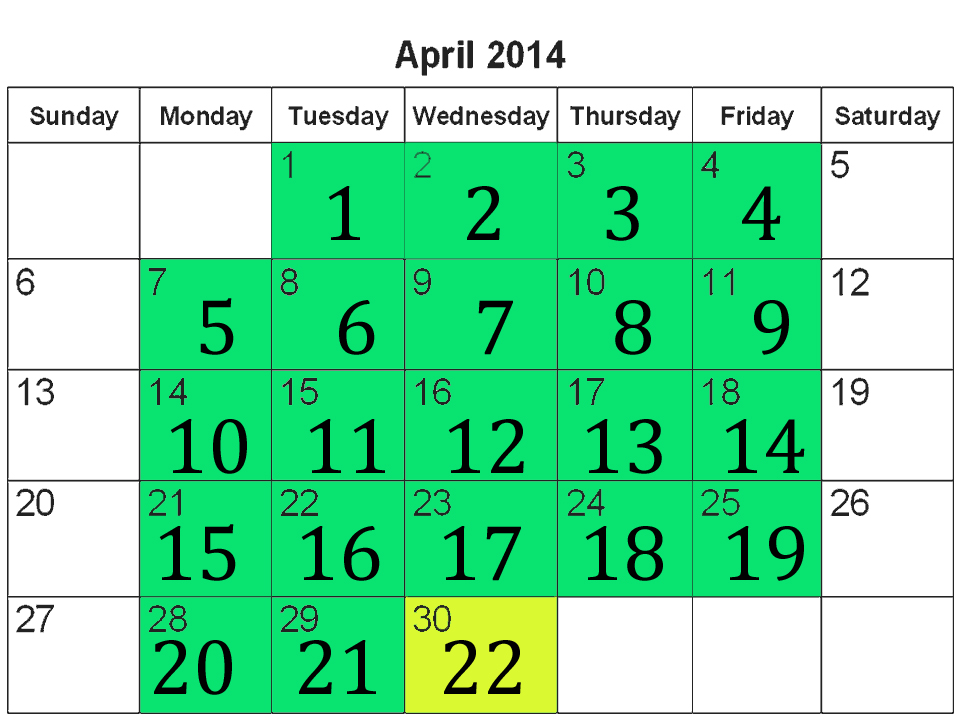

April 2014

- 22 Posting Days

- 4 Mail Mondays

- Likely Client Closeouts on 28th of the Month.

New April 2014

New April 2014

- 23 Posting Days

- 4 Mail Mondays

- Collector Closeout Before Client Closeouts

>

…So, if you look at the comparison, by changing the closeout date; you still get the Mail Mondays, you add an additional posting day to the month (not including Saturdays or Sundays) and you beat the client closeouts. A lot of people will look at this and think “Oh heck no!”, but hold up a sec.

The EOM Myth

Going back to the opening quote of this post, WE, the people in the industry, invented this mystical creature named “closeout” that happens to fall on the last day of the month. Sure, it makes sense (kind of). You have the entire month to work deals and close accounts, and it’s nice to give the consumer until the end of the month. But again, we made it up. How many bills do you have that all fall on the last day of the month? The only bill that’s usually do on the first of the month is rent. And that’s usually to benefit the landlord and the tenant by pro-rating the first month’s rent if you came in after the 1st.

The company that changed their closeout to the 24th stumbled upon a big discovery. By changing the closeout, the talk-offs changed. Collectors were extending deals until the 24th, securing payments before then and acting as though it were EOM (end of month). The EOM myth was revealed. Collectors were bringing in more money on the 24th than they had ever brought in on the last day of the month. Mostly because they were securing payments before the last week. Meaning people had less time to pull out of a commitment.

Not only that, but all the competitors (other creditors collecting from the same debtor) were extending deals to the last day of the month. These collectors were getting the money before anyone else. Because they had to secure it by their new closeout on the 24th.

The BEST benefit went to both the company and the collectors.

By closing out on the 24th, the collectors were able to get a head start on their following month. By changing the closeout to the 24th, you would see SIFs and PIFs coming in on closeout (the 24th), but all the PPAs and post judgment payments still came in at the end of the month. Usually because collectors were always telling people to pay by EOM.

The company and the collectors also got two closeouts. The collectors had their closeout on the 24th, full of raffles and contests. The company still had their closeout on the last day of the month. So this allowed for double the closeouts, basically double the fun. By doing this, the energy stays high, and the slump you get in the beginning of the month isn’t as bad because the collectors are already in their second week of collections, working on projecting goal and preparing for closeout. And now the company is better situated in their projections because they can gain confidence with a strong push on the 24th, one whole week before the end of their month.

Let’s just say not everyone will agree with changing a closeout date to a week before the end of the month. But you never know, it could bring in that extra bit of energy to take your shop to the next level.