What Does a Collection Attorney Do? Asked and Answered

Recovering debts and loans is a crucial part of running a successful business. Business owners that consistently get let down by debtors or are forced to keep forgiving debts may, in time, run into huge debts themselves. After all, how are you supposed to run your business and meet all the non-stop financial demands with little to no cash flow due to unpaid debts? That, my friend, is why you MUST see to it that you recover as many unpaid debts as possible!

However, here’s a note of caution–there are so many rules, regulations, and potential legal landmines to watch out for when recovering debts. And let’s be frank, navigating the legalities of debt collection is no walk in the park. As a business owner dealing with late-paying customers, you can easily go from being an innocent original lender to a guilty oppressor if care is not taken. That’s where hiring a collection attorney comes in!

These legal juggernauts know the ins and outs of debt collection like the back of their hands. Thus, they can be an invaluable asset in getting you the money you’re owed without all the migraine-inducing hassle. So today, I’m going to talk about what a debt collection attorney can do for you and your business!

What Does a Collection Attorney Do?

Who is a collection attorney? What exactly does a collection attorney do? Why should you hire a debt collection agency to fight your battle in the first place? What about how to hire a debt collector that gets you your money and keeps you in business? These are all pertinent queries that will be addressed shortly!

This is the part where we pull back the curtain and reveal the inner workings of these debt-collecting professionals. By the time we’re done, you’ll be able to spot a collection attorney from a mile away. Let’s do this!

What is a Collection Attorney?

A collection attorney is a lawyer who specializes in debt collection. This usually involves recovering debts arising from medical bills, credit card debts, consumer debts, credit reporting, or any other debt collection cases. These legal specialists are the ones you call when the polite reminders, angry phone calls, and “your account is now in collections” letters just aren’t cutting it anymore. They’re experts at navigating the complex web of laws and regulations surrounding debt collection. And they know how to get results where regular folk might fail miserably.

But what really sets a collection attorney apart is their laser-sharp focus. While your average lawyer has to be a jack-of-all-trades, able to handle everything from traffic tickets to complex business disputes, a collection attorney lives and breathes to collect debts. They know all the tricks of the trade, and they’re up-to-date on the latest legal changes. And they’ve got a sixth sense for sniffing out deadbeats and getting them to cough up what they owe.

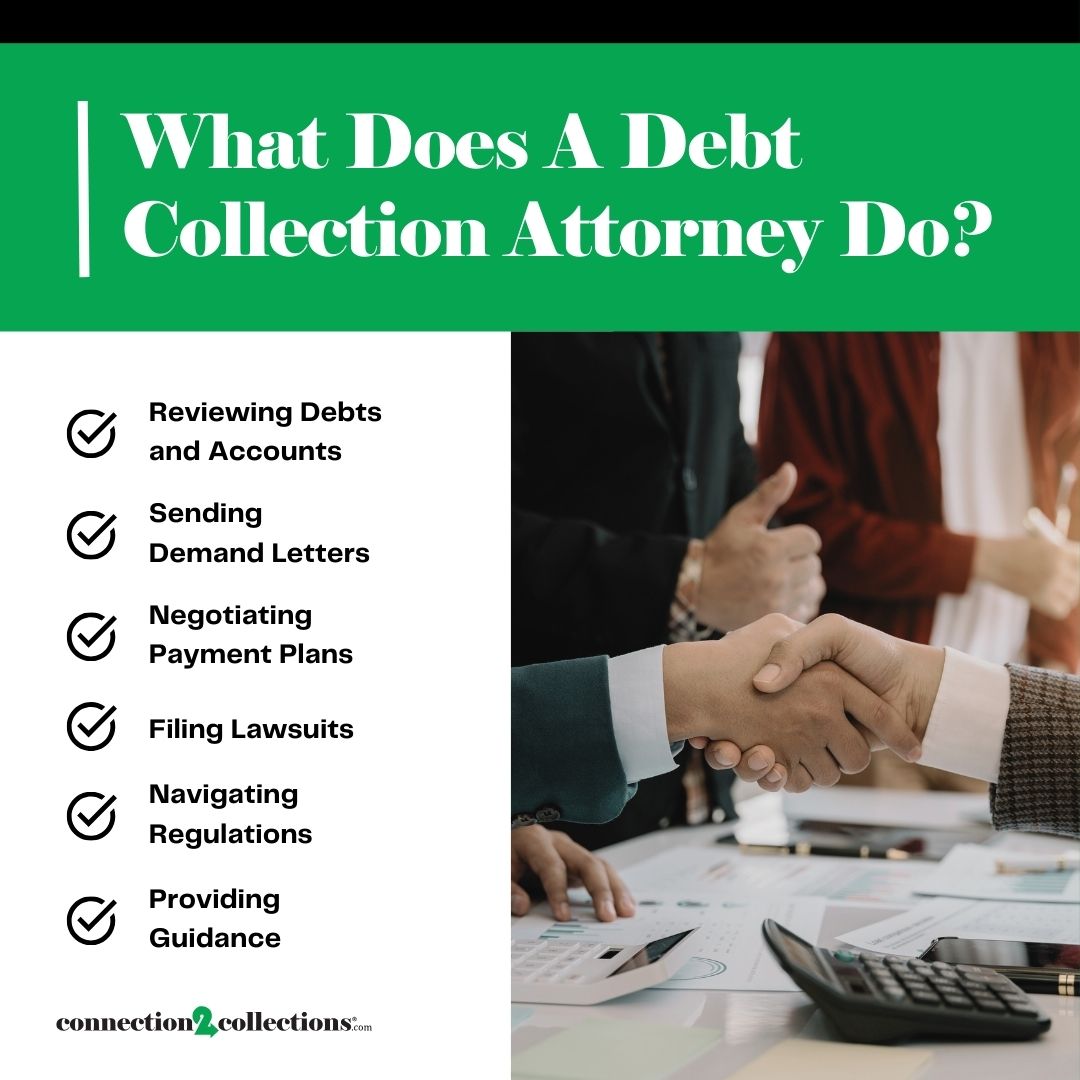

What Does a Debt Collection Attorney Do?

Debt collection can be a complex and often frustrating process. However, having a skilled collection attorney on your side can make all the difference. Let’s take a closer look at the key responsibilities of a debt collection attorney:

Reviewing Debts and Accounts

The collection attorney’s first task is to examine the accounts and debts assigned to him or her for recovery. They will sift through all the information and confirm whether or not the claims and amount owed are valid. They’ll also check to see what collection efforts have been made so far.

Such a detailed examination allows them to devise the best course of action. They will review the payment history, communication records, and any other documentation to gain a clear picture of the debt and the debtor’s situation.

Sending Demand Letters

Once the accounts pass the vetting stage, the collection attorney springs into action and sends out formal demand letters. These letters outline the debt, the implications of not paying, and a clear timeline for resolution. It aims to nudge the debtor who refuses to pay into making good on their obligations before things escalate. The letters are written to be firm without being too aggressive. You want to strike the right balance between motivating the debtor and not crossing any legal lines.

Negotiating Payment Plans

There are times when a debtor actually wants to pay back what they owe. However, due to financial hardships, they cannot. In such instances, a collection attorney may be able to sit down with the debtor and draft an acceptable payment plan. This allows the debt to be paid over time while still preserving the creditor’s right to collect. The attorney will evaluate the debtor’s financial situation. Then craft a payment plan agreeable to both the creditor and the debtor. And document the agreement.

Filing Lawsuits

If the debtor remains unresponsive or unwilling to pay, then the collection attorney will move to the next step, which is to file a lawsuit. They will take care of all legal paperwork, represent the creditor in court, and fight to secure a judgment in their favor. This judgment can then be used to garnish wages, seize assets, or take other measures to recoup the owed funds. The debt collection lawyer will thoroughly analyze the case. Gather all necessary evidence, and maximize the chances of a favorable outcome.

Navigating Regulations

Debt collection is a highly regulated industry, with strict laws governing everything from communication methods to allowable fees. A skilled collection attorney keeps up-to-date on these regulations and ensures that all collection efforts are fully compliant. This protects the creditor from costly lawsuits or regulatory fines. The attorney will be well-versed in the Fair Debt Collection Practices Act, state-specific laws, and any industry-specific regulations that may apply.

Providing Guidance

Perhaps most importantly, a collection attorney serves as a trusted advisor. And guiding their clients through the complex and often frustrating world of debt recovery. They offer strategic advice, share industry best practices, and help their clients make informed decisions that maximize their chances of success. Whether it’s developing a comprehensive collection strategy, identifying the most effective legal actions, or simply providing a sounding board for tough decisions, the collection attorney is an invaluable partner in the debt recovery process.

A skilled debt collection attorney is an invaluable asset in the complex and ever-changing world of debt recovery.

These professionals are members of the legal community who come equipped with extensive industry experience, regulatory expertise, and different collection strategies. With the right collection attorney on their side, you can walk the tightrope that is debt recovery without running afoul with the debt collection practices act.

So, if you’re done running around chasing delinquent payments, hitting dead ends, and risking expensive legal action, you might want to bring a collection attorney into the mix. Their valuable insights will turn your debt collection process from a migraine-inducing experience to a well-oiled, strategic process.

Becoming a member of the Connection2Collections platform is a great way to connect with industry leaders and take your debt recovery aspirations to the next level. But that’s not all! You’ll be up-to-date with everything important and learn tested-and-trusted from the veterans. Whether you are an individual or company, joining Connection2Collections can help you navigate all the complexities of debt collection and achieve the desired results. See you there!